Resources

There are many ways to judge how well a company is doing. In this article, we explore an important metric, EBITDA margin (EM), that allows analysts to evaluate company performance. First, we answer, “What is EBITDA Margin?” and review the EBITDA margin formula.

Then we show how to calculate EBITDA margin and answer the question, “What is a good EBITDA margin?” Next we report on average EBITDA margin by industry and explain how Assets America® can help. Finally, we answer some frequently asked questions about EM.

What is EBITDA Margin?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a metric that reveals a company’s operating profit compared to its revenue. Since it is a common metric, you can use it to compare similar companies within the same industry. EBITDA margin relates to similar metrics:

- EBITA: Earnings Before Interest, Taxes, and Amortization.

- EBIT: Also known as operating margin, it is Earnings Before Interest and Taxes.

- Net Operating Income (NOI): This is EBITDA within a real estate context, applying to properties instead of companies.

EBITDA approximates cash flows generated by operations and expresses a company’s earnings potential. Conversely, NOI shows a property’s cash earnings.

EM ignores the profit impact of debt financing costs, taxes, and the non-cash expenses depreciation and amortization. In other words, it is the percentage of each revenue dollar remaining from core operations. Therefore, EM does not depend on a company’s capital structure.

Video – What is the EBITDA Margin?

EM Is Non-GAAP

EM is quite useful, but it does not follow generally accepted accounting principles (GAAP). Despite being non-GAAP, EM provides analysts important insights into a company’s operating efficiency. EM accomplishes this by excluding the effects of non-cash expenses, taxes, and interest. You can think of EBITDA as the cash income from day-to-day operations.

Apply For Financing

EBITDA Margin – Pros and Cons

Pros

- EM serves as a comparative benchmark to evaluate a company’s operating efficiency relative to competitors.

- EM trends can alert management to investigate sources of operational inefficiencies.

- It excludes certain expenses that management cannot control. Therefore, EM provides insights on how well an organization performs.

Cons

- EM excludes the effects of debt. This can distract investors from problems like overly leveraged capital structures. You should not measure the performance of highly leveraged companies using EM, because large interest payments can be devastating.

- Typically, EM is higher than profit margin. Therefore, emphasizing EM distracts from low profitability as a measure of company success.

- As a non-GAAP metric, companies can skew EM by calculating it in a favorable way. For example, management can choose a depreciation method that produces the best numbers.

- It’s misleading to compare EMs across different industries, since cost structures can vary significantly. For example, certain industries, like real estate, receive tax breaks unavailable to other industries.

EBITDA Margin Formula

The EBITDA margin formula is:

EM = (Operating Income + Depreciation + Amortization) / Total Revenue

EBITDA Margin Components

The components of EM are:

- Operating Income: This is the revenue from operations minus operating expenses, including the cost of goods sold, overhead, depreciation, and amortization. Importantly, operating income excludes tax expense and interest on debt.

- Depreciation: An accounting method to allocate the costs of physical (tangible) assets over its life expectancy. You cannot expense the purchase or construction costs of a long-term asset all at once. Instead, you subtract a portion of the expense each year over the asset’s useful life. Depreciation measures the utilization of an asset’s value by tying cost to the benefit gained over the asset’s lifetime. The cash flow for the asset’s acquisition occurs in the first year. Since depreciation occurs over the asset’s lifetime, it represents a deductible non-cash expense.

- Amortization: This is an expense similar to depreciation, except it refers to intangible assets. It’s a way to expense the cost of patents, trademarks, copyrights, goodwill, and other intangible assets over their lifetimes. Like depreciation, amortization is a non-cash expense.

- Total Revenue: This is the total receipts from sales, adjusted for discounts and returns. We also call it gross income.

How to Calculate EBITDA Margin

An example will serve to illustrate how to calculate the EBITDA margin.

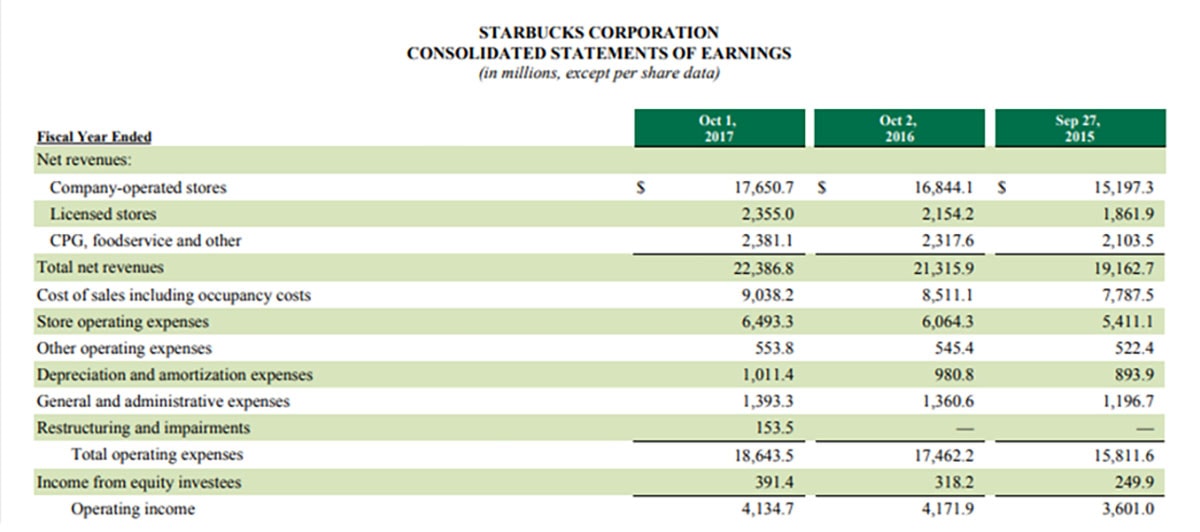

Consider the following facts from the 2017 annual report of Starbucks:

The following chart shows how to calculate Starbucks EM for fiscal 2017:

| ITEM | VALUE (Millions) | |

|---|---|---|

| Operating income | $4,134.7 | |

| Depreciation and amortization expenses | $1,011.4 | |

| EBITDA | $5,146.1 | |

| Total net revenues | $22,386.8 | |

| EBITDA Margin = EBITDA / Total net revenues | 22.99% | |

How to Calculate EBITDA and EBIT on Excel

In the video, we make use of the function VLOOKUP. If you find it difficult to understand, then check out this helpful VLOOKUP tutorial.

EBIDTA Calculator

What is a Good EBITDA Margin?

What is a good EBITDA margin? A good EM is relative because it depends on the company’s industry. Naturally, a higher EM implies lower operating expenses relative to total revenue.

Ideally, a company wants an EM near the top for its industry, or at least higher than industry average. Conversely, a below-average EM may indicate problems with cash flows and profitability.

Generally, certain industries, such as asset-heavy ones, will have relatively high EMs. Specifically, asset-heavy companies have larger depreciation expenses. Since you add depreciation to revenues when figuring EM, the value you calculate will be higher.

In any event, EM is almost always less than 100%. Clearly, EM could only reach 100% if a company had no taxes, interest, amortization, or depreciation. Since these expenses cannot be negative amounts, it’s impossible to have an EM greater than 100%. If you calculate an EM greater than 100%, you’ve probably miscalculated.

You can view EM as a liquidity metric, as it shows remaining cash income after paying operating costs. Clearly, this reveals a business’ ability to pay its bills.

Average EBITDA Margin by Industry

The following table shows the 10 industries with the highest EMs as of January 5, 2019:

| Industry Name | No. of Firms | EBITDA/Sales |

|---|---|---|

| Green & Renewable Energy | 21 | 47.50% |

| Utility (Water) | 19 | 45.98% |

| R.E.I.T. | 238 | 45.02% |

| Transportation (Railroads) | 10 | 43.36% |

| Tobacco | 17 | 41.47% |

| Precious Metals | 91 | 39.84% |

| Semiconductor | 72 | 37.19% |

| Oil/Gas (Production and Exploration) | 301 | 35.31% |

| Real Estate (General/Diversified) | 11 | 34.72% |

| Cable TV | 14 | 32.42% |

The following table shows the 10 industries with the lowest EMs as of January 5, 2019:

| Industry Name | No. of Firms | EBITDA/Sales |

|---|---|---|

| Retail (General) | 19 | 6.50% |

| Oilfield Services/Equipment | 134 | 6.43% |

| Engineering/Construction | 52 | 5.66% |

| Healthcare Support Services | 111 | 5.04% |

| Food Wholesalers | 18 | 4.28% |

| Retail (Grocery and Food) | 12 | 4.21% |

| Electronics (Consumer & Office) | 19 | 0.44% |

| Brokerage & Investment Banking | 38 | 0.40% |

| Bank (Money Center) | 10 | 0.00% |

| Banks (Regional) | 633 | 0.00% |

Regarding EBITDA margin by industry, the data shows that the average EM across all industries was 15.25%. The average EM without financials was 16.18%.

How Assets America® Can Help

You can borrow money without hurting EBITDA and EM because these metrics exclude interest expense. Assets America® provides both C&I loans and CRE loans starting at $10 million with no upper limit. If your business needs a commercial loan, we invite you to contact us for a free consultation at 206-622-3000.

Frequently Asked Questions

What is the difference between Operating Margin vs EBITDA?

Both are measures of a company’s profitability. Operating margin is the ratio of operating income to operating expenses. EBITDA refers to earnings before interest, taxes, depreciation, and amortization. The latter two are included in operating margin. EBITDA margin is EBITDA divided by revenue.

What is the adjusted EBITDA Margin?

Adjusted EBITDA margin is EM with certain corrections to normalize income and expenses. Accordingly, you adjust for items such as above/below market rents, above/below market employee compensation, and one-time expenses/revenue. Also, you add back deductions for personal expenses that a business pays on behalf of owners.

How do you define negative EBITDA Margin?

A negative EBITDA means that you lost money, even when you add back depreciation and amortization. Frequently in the financial industry, depreciation and amortization is zero. In that case, negative EBITDA is the same as negative operating income.

What is the difference of Gross Margin vs EBITDA Margin?

Gross margin is equal to sales minus the cost of goods sold. Conversely, EBITDA is sales minus operating expenses, excluding depreciation and amortization. Both exclude interest and taxes. Also, the gross margin ratio is gross margin divided by net sales. And yes, EBITDA margin is EBITDA divided by net sales.