Blog

Ultimate Guide to Operating Budgets

March 18, 2020

If you’ve been looking for a useful operating budget definition in a real estate context, this article will be very helpful. We cover:

- What is an Operating Budget?

- How to Calculate & Prepare OBs

- OBs for Multifamily Properties

- Helpful Examples

- Operating Budget vs Capital Budget

- Sample Templates (Downloadable)

- How Assets America® Can Help

- Frequently Asked Questions

- Related Articles

What Is an Operating Budget?

In real estate, an operating budget describes the income and expenses for a property. We use it to track an asset’s success and viability. Typically, property managers will prepare and present the annual operating budget to landlords before the year starts.

To answer “What is an operating budget?”, we first must define the term “Opex,” which stands for operating expenses. This discussion is in the context of commercial real estate.

How Assets America® Can Help

You can count on Assets America® for professional financing services, with loan amounts starting at $10 million with no upper limit. Whether you need loans to for capital expenses or operating expenses, we can offer you financing when others won’t. Our network of private money funding sources and institutional lenders can offer a wide selection of financing options. Contact us today at (206) 622-3000 for a free and confidential consultation, or simply fill out the below form and for a prompt response!

Apply For Financing

Operating Expenses (Opex)

Opex is the out-of-pocket costs of operating and maintaining a real estate property. For example, these include:

- Insurance

- Property taxes

- Management and administration fees

- Common area maintenance

- Utilities (Including RUBS)

- Contract services (i.e., security, janitorial, landscape, etc.)

- Supplies

We exclude certain other costs from Opex, even though the landlord may be responsible for them. For example, these include:

- Consultant fees

- Market study costs

- Advertising and marketing

- Refinancing and debt service

- Tenant improvements

- Capital improvements and structural repairs

The responsibility for paying Opex depends on the lease type, such as triple net, full-service gross, or modified gross. In a triple net lease, lessees (tenants) pay property taxes, insurance, and maintenance expenses. In other lease types, the landlord (owner) pays some or all of these expenses.

Keep in mind that landlords can manipulate operating expenses by accelerating or deferring certain expense items.

Gross Operating Income (GOI)

A property’s GOI includes rental income and other sources of revenue, such as vending and laundry machines. We start with gross potential income (GPI), the idealized revenue figure under perfect conditions. For budgetary purposes, the property manager must forecast lost income due to vacancies, incentives, and credit losses. We subtract these costs from GPI to compute GOI.

By the way, another name for gross operating income is effective gross income (EGI). In fact, effective gross income is more commonly used in the U.S.

Importantly, an operating budget is only as realistic as its predicted GOI. That’s why property managers must use solid data to forecast vacancy and credit losses. That data includes past performance, rent reviews, supply/demand figures, and lease expiry dates.

For brand new properties, you can estimate losses using data from comparable properties. A good property manager keeps an eye on market rents and plans throughout the year.

In the next section, we cover how to calculate an operating budget.

How to Calculate and Prepare

An operating budget definition addresses the purpose and contents of the budget. In fact, the operating budget definition pertains directly to operating income and expenses.

The basic calculated figure from an operating budget is net operating income (NOI).

Net Operating Income = Gross Operating Income – Operating Expenses

The format starts with gross potential income, an estimate of the maximum income over the next 12 months. This is followed by items that reduce GPI and the resulting GOI (or EGI).

The next section lists estimates for all operating expenses for which the landlord is responsible. We sum these expenses to get the property’s total operating expenses for the year.

Finally, we subtract operating expenses from gross operating income to get net operating income. This is a before-tax figure and excludes the following:

- Loan interest and principal payments

- Depreciation

- Amortization

- Capital expenditures

- Income taxes

We can subtract these costs from NOI to get net income (NI). This is the net profit the property generates.

The property manager can prepare several versions of the operating budget under different assumptions. This is a sensitivity analysis that varies certain variables. For example, these include changes to market rents, interest rates, available supply, vacancy, credit losses, and more. This gives us a set of scenarios from best-case to worst-case.

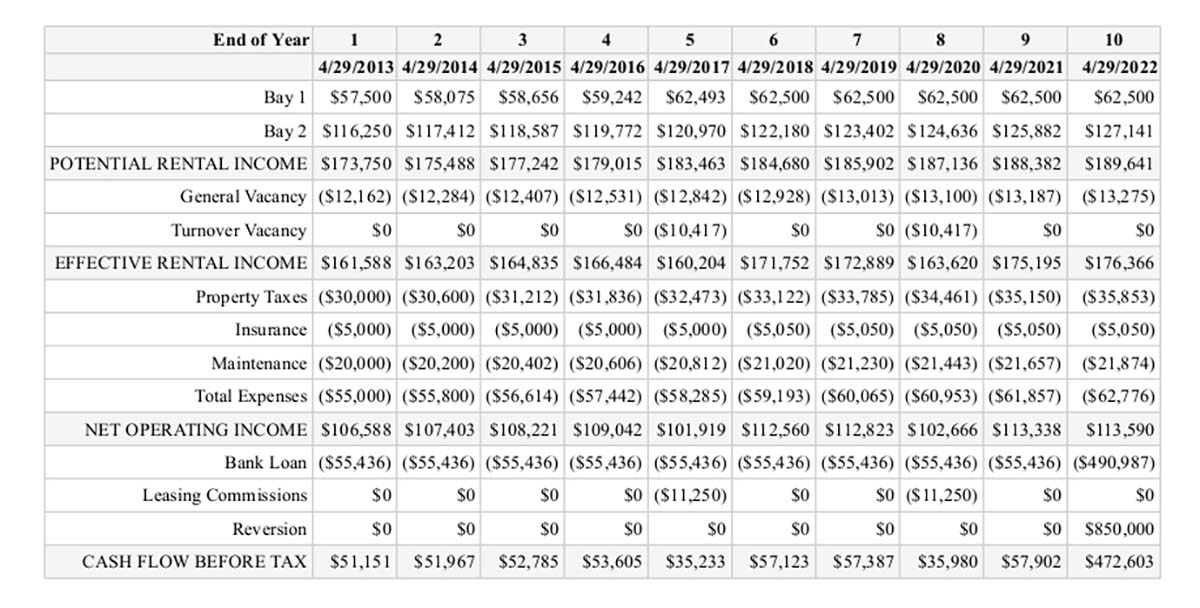

Many budgets contain multi-year data (see below example). In addition, the budget may show adjustments to NOI to get cash flow before tax (CFBT).

Operating Budget for Multifamily Investments

If you own a multifamily property or apartment building, you create an operating budget for several reasons, including:

- Setting performance targets

- Creating a baseline to review property management performance

- Projecting income and expenses based on market assumptions and drivers

- Recognizing problems that you must address

In this section, we assume you use a property management company.

Multifamily Property Income

Tracking property manager performance is critical. If you repeatedly fail to realize projected income targets, you may need a new manager. You should evaluate your property manager’s performance along these dimensions:

- Leasing projections versus actual vacancies: Does your manager meet its targets for new-unit leases and average occupancy rate?

- Lease renewal projections: Are tenants rolling over their leases?

- Future project estimates from higher revenue: Can your manager secure rent and other revenue increases? Is it able to introduce a utility reimbursement program that ultimately increases revenues?

- New revenue sources: Can the manager find untapped sources of revenue? For example, can it add and charge for amenities, such as recycling or vending?

Multifamily Property Expenses

You want your property manager to cut expenses as much as possible without compromising services. Therefore, you will want to include these factors when you evaluate the manager’s performance:

- Projecting lower current expenses: Did the manager meet its goals to reduce expenses? For example, did it improve mechanical system operating efficiency? Doing so should reduce your utility costs.

- Costs of service providers and third-party vendors: Did the manager conduct annual reviews for services such as trash removal, cleaning, lawn care, and property insurance? Was the manager able to hold down increases, or at least not exceed budget projections?

- Incorporating suggestions from service providers: It’s important to know whether your property manager is open to cost-cutting suggestions from service providers. Do the cost savings show up in budget projections?

- Reviewing property management fees: Is your property manager gouging you? Do you feel you are getting your money’s worth?

If you need a change, read our comprehensive article, How to Find the Best Commercial Property Management Companies.

Operating Budget Example

The following is an operating budget example.

This just one type of operating budget example. Note the fluctuations in the annual cash flow before tax. These are primarily due to leasing commissions. LCs are fees the landlord pays to a real estate broker for introducing a tenant that successfully completes a lease in the multifamily property.

Capital Budget vs Operating Budget

It’s important to understand capital budgets vs operating budgets. The capital budget forecasts capital expenditures (Capex), which adds to the property’s cost basis. These are major purchases or costs for multi-year use.

The chief reasons for capital expenditures are improvement, expansion, and replacement. Usually, you depreciate capital expenditures over a multi-year period. Typically, a capital budget extends over 5 to 10 years.

Typical capital expenditures include:

- Property construction or acquisition

- HVAC systems

- Elevators

- Security systems

- Fixtures and furniture

- Fixed equipment

- Communication systems

- Lighting

- New finished space

- Other fixed assets

- Preventative maintenance

Capital expenditures increase the value of noncurrent assets on the balance sheet. We also list them as investment activities on the cash flow statement. The depreciation period for real estate capital expenditures can extend over decades.

You deduct depreciating capital expenditure over multiple years. However, you deduct operating expenses in the current year. Note that you can treat Capex as an operating expense if you lease instead of purchase.

Replacement Reserves

You can earmark Capex funds for planned long-term improvements over two or more years. We call these funds replacement reserves. This procedure helps you account for future expenditures while avoiding surprises. For example, you might have a multiyear maintenance cycle in which you repair and improve common areas.

The Difference Between the Operating and Capital Budget

Sample Operating Budget Template

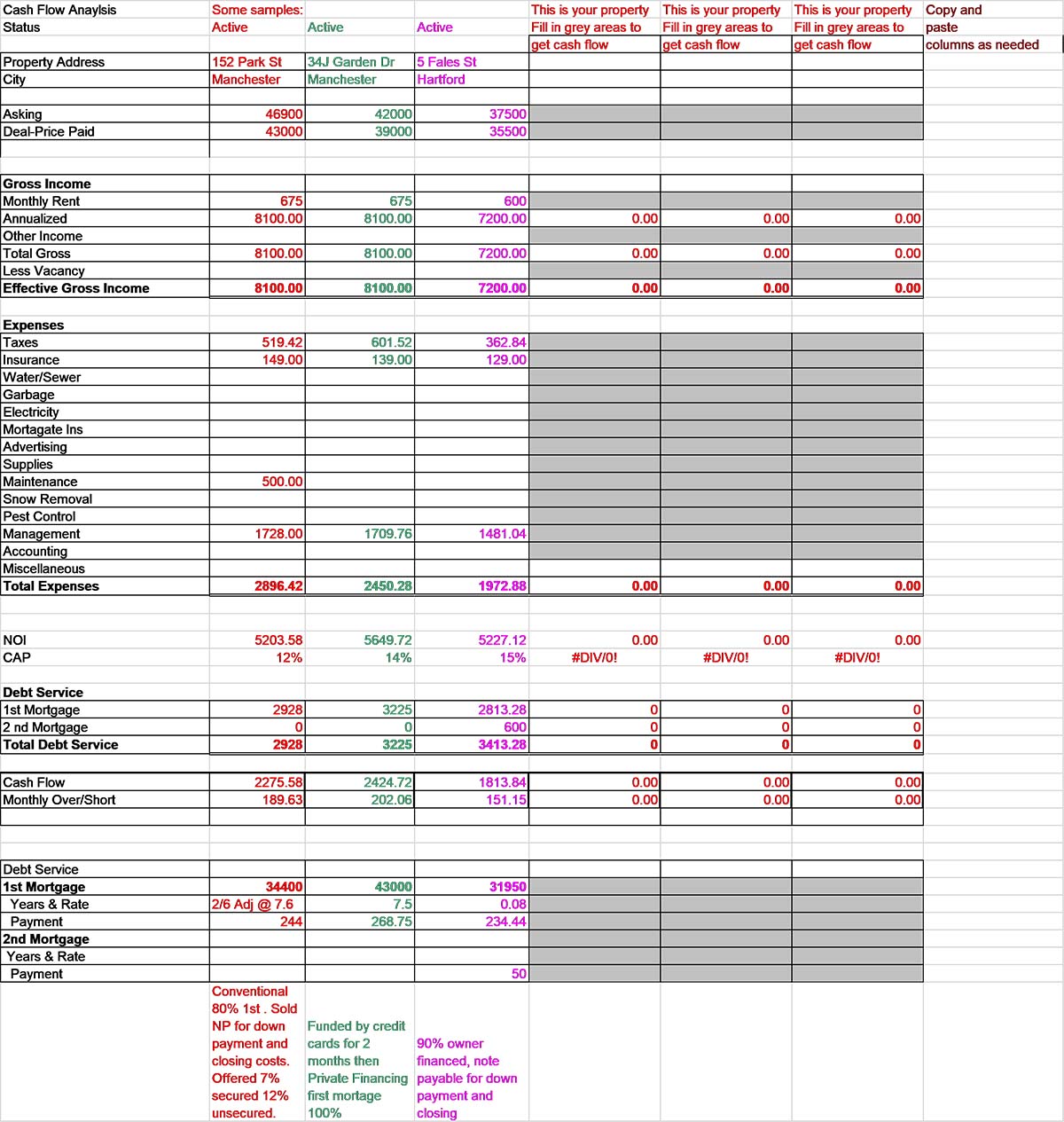

There are many operating budget templates available on the internet, and some are free. You can find 12+ operating budget templates for schools, non-profits, small businesses, restaurants, startups, hospitals, and more. Or you can download this free template, which we think is a comprehensive and visually stunning version.

Here is another version for visual reference:

Frequently Asked Questions

Are operating budgets different for non-profits?

Yes, non-profits need to raise revenue and lower costs, but there are no profits. Counter to assumption, non-profit operating budgets do not have to balance. In fact, they can have a surplus or a deficit.

What is a net operating budget?

A net operating budget can refer to net income and net expenses. Clearly, net income denotes a property’s profitability. The net operating budget calculates net operating income separately from total cash flows.

What is an annual operating budget?

You can format most operating budgets to cover one or more years. In an annual budget, you can break down your operating income and expenses on a month-by-month basis and then total the 12-months to see the annual budget.