Blog

Aircraft Acquisition – Ultimate Step-by-Step Guide

December 06, 2019

If you want to purchase aircraft, you’d like the process to be efficient. This article describes the planning you need for aircraft acquisition and includes sample documents. Also, we explore the relevant FAA regulations, and explain how to register and insure your plane. Finally, we describe how Assets America® can help, and we answer a few frequently asked questions.

The Most Expensive Private Jets Owned by Celebrities

Aircraft Acquisition Planning

There are four standard ways to acquire or use an aircraft.

1. Charter

This is a good solution if you fly up to 50 hours per year. You don’t have to worry about capital costs or aircraft maintenance. Instead, you pay fees only for aircraft utilization. Unfortunately, the biggest problem is availability during high-demand periods.

2. Fractional Ownership

This one is best if you fly between 50 and 100 hours per year. You purchase shares in an aircraft in return for a percentage ownership. Specifically, the fraction program operates the aircraft and gives you enhanced access when you need it. Usually, the fractional program ends after three to five years. Thus, you contain your costs and receive certain tax benefits.

3. Leasing

With wet leasing, a lessor provides the aircraft, maintenance, crew, and insurance. Accordingly, you pay for operational hours, fuel, duties, taxes, airport fees, and other usage costs. Usually, wet leases run for up to two years. In contrast, with dry leasing you receive only the aircraft from the lessor. You are responsible for all other costs. Normally, dry leases run for more than two years.

4. Outright Purchase

If you fly more than 150 hours per year, you should favor outright purchase. Undoubtedly, this option requires considerable capital costs and planning, often with the support of a qualified advisor. Nevertheless, you must decide whether you want a new or used aircraft, and how to manage and staff it. Importantly, you pay for tax, insurance, financing, and legal services.

If you fly more than 150 hours per year, you should favor outright purchase.

Moving forward, the focus of this article is acquiring full ownership of aircraft, whether commercial jets, private jets, or helicopters.

In addition, you may be interested in How Much Does a Private Jet Cost? | Ultimate Breakdown Guide and How Much Does a Helicopter Cost? | Ultimate Breakdown Guide. Both articles deal with the upfront and ongoing costs of owning aircraft.

Airplane Financing

Assets America® is your one-stop source for all kinds of aircraft financing transactions. For example, these include aircraft acquisition, leases, and sale-leasebacks. We offer financing on aviation transactions of $10+ million, with no upper limit. Our syndicate of funding sources can deliver financing to you efficiently and professionally. If you’re interested, please contact us at 206-622-3000 for a discreet and confidential consultation, or simply fill out the form below and expect and prompt response — when you think aircraft loans/financing, think Assets America®!

Apply For Financing

Aircraft Acquisition and Planning

To be sure, your plan will contain a number of early and late steps.

Early Steps

These steps kick off your acquisition plan:

- Select your dealer, broker, or transaction advisor. Your savings should comfortably exceed fees. Also identify a specialist aviation attorney.

- Pick an aircraft that conforms to your requirements.

- Draw up a Letter of Intent.

- Have your attorney review the structure of the transaction and the resulting tax issues.

- Place a deposit in escrow and work out release terms.

- Negotiate a finance term sheet with the lender.

- Commission a title search and identify any liens. Purchase title insurance.

- Begin negotiating the Aircraft Purchase Agreement (APA), which describes who is responsible for various costs.

- Execute the APA.

- Technical team reviews back-to-birth records and logbook.

- Appraise the aircraft to support financing.

- Perform a test flight, which may be a relocation flight. The APA identifies who pays this cost.

- Inspect the aircraft.

- Review the finance documents.

- Begin drafting the sale document.

- Determine ownership structure and, if needed, the importation plan.

- Decide how to register the aircraft.

- If necessary, select an aircraft operator.

- Request legal opinions regarding different jurisdictions.

- Have the seller fix any problems identified during the pre-purchase inspection.

- Negotiate any changes to the sale document.

Later Steps

These steps complete the acquisition process.

- Reserve the aircraft’s registration number.

- Acquire the certificate of airworthiness and any required export certificates.

- Perform the final review of documentation.

- Assign maintenance plans.

- Agree on the final closing points.

- Arrange insurance.

- Resolve discharges and liens.

- Wire money to escrow.

- Ferry the aircraft to the shipping destination.

- Issue the appropriate tax opinions for the jurisdiction. You need to be aware of various taxes, including sales tax, use tax, aircraft registration fees, and ad valorem or personal property taxes.

- Verify that the seller de-registers the aircraft.

- Perform the closing call.

- Sign the sale document.

- Verify that the escrow agent receives the proof of seller’s de-registration.

- File the bill of sale and registration application.

- File liens with International Registry.

- Receive the flight wire registration from FAA.

- Import the aircraft if required.

- Settle any miscellaneous bills.

- Protect the asset with a hangar and engine covers.

Congratulations, you are ready for your maiden flight as owner.

Documentation

The following are samples of various required documents.

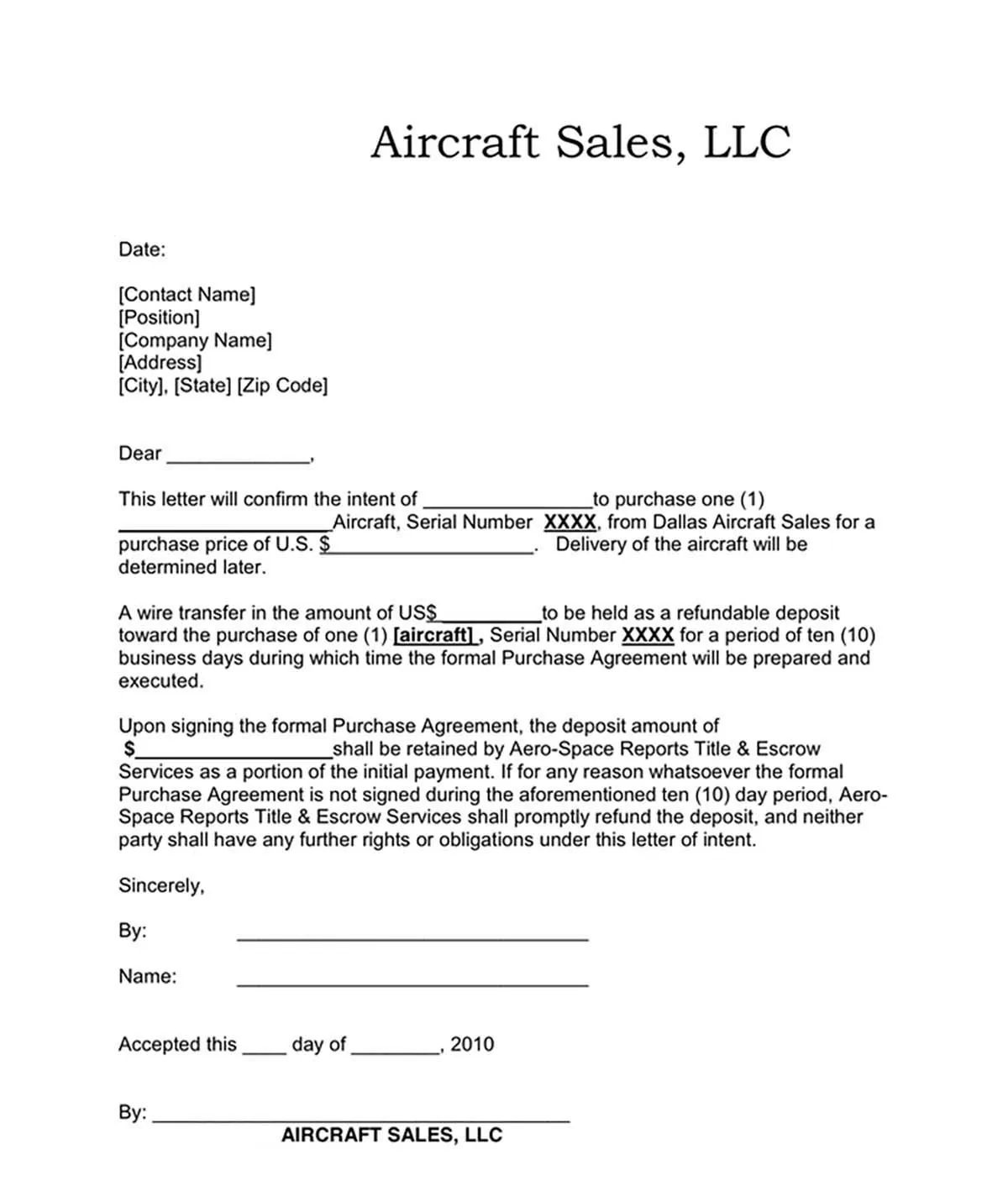

Letter of Intent

You draft the Letter of Intent or Offer to Purchase once you’ve identified the desired aircraft. Your agent then arranges a demonstration flight and visual inspection.

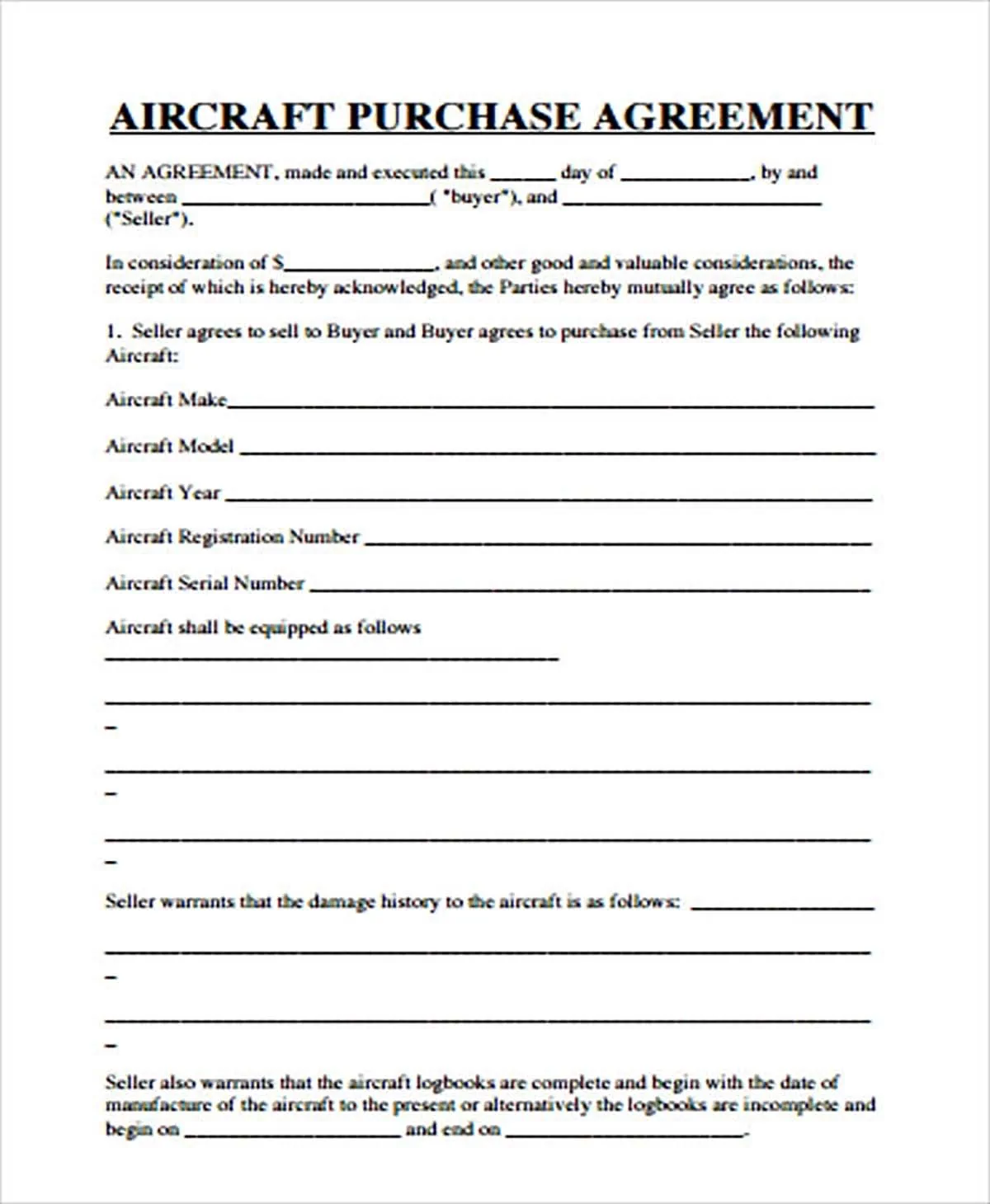

Aircraft Purchase Agreement

The APA describes the purchase terms and allocates costs between the buyer and seller.

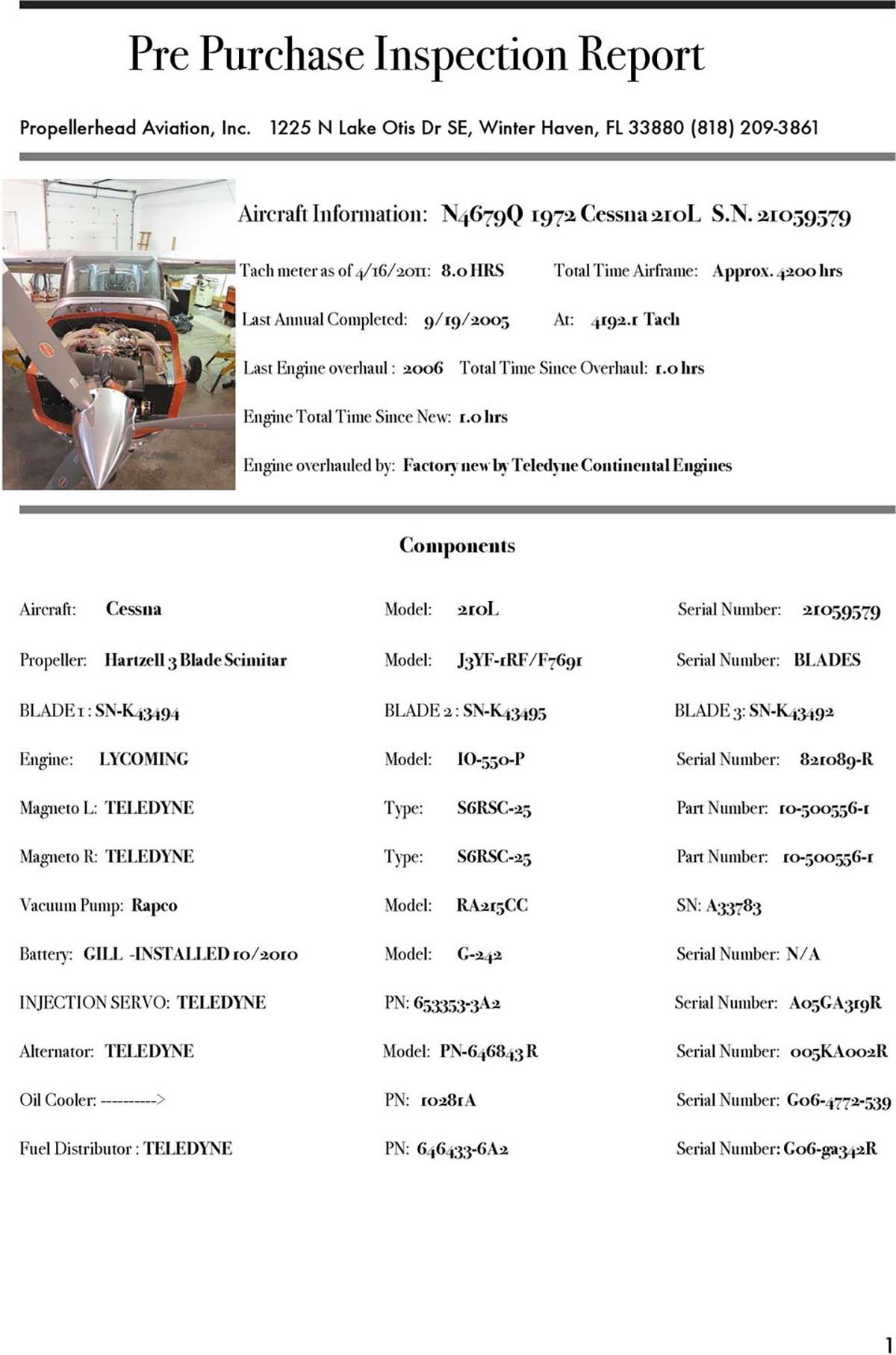

Pre-Purchase Inspection Report

The inspection facility issues a report showing any discrepancies or non-airworthy items. Accordingly, they produce a pre-purchase inspection report.

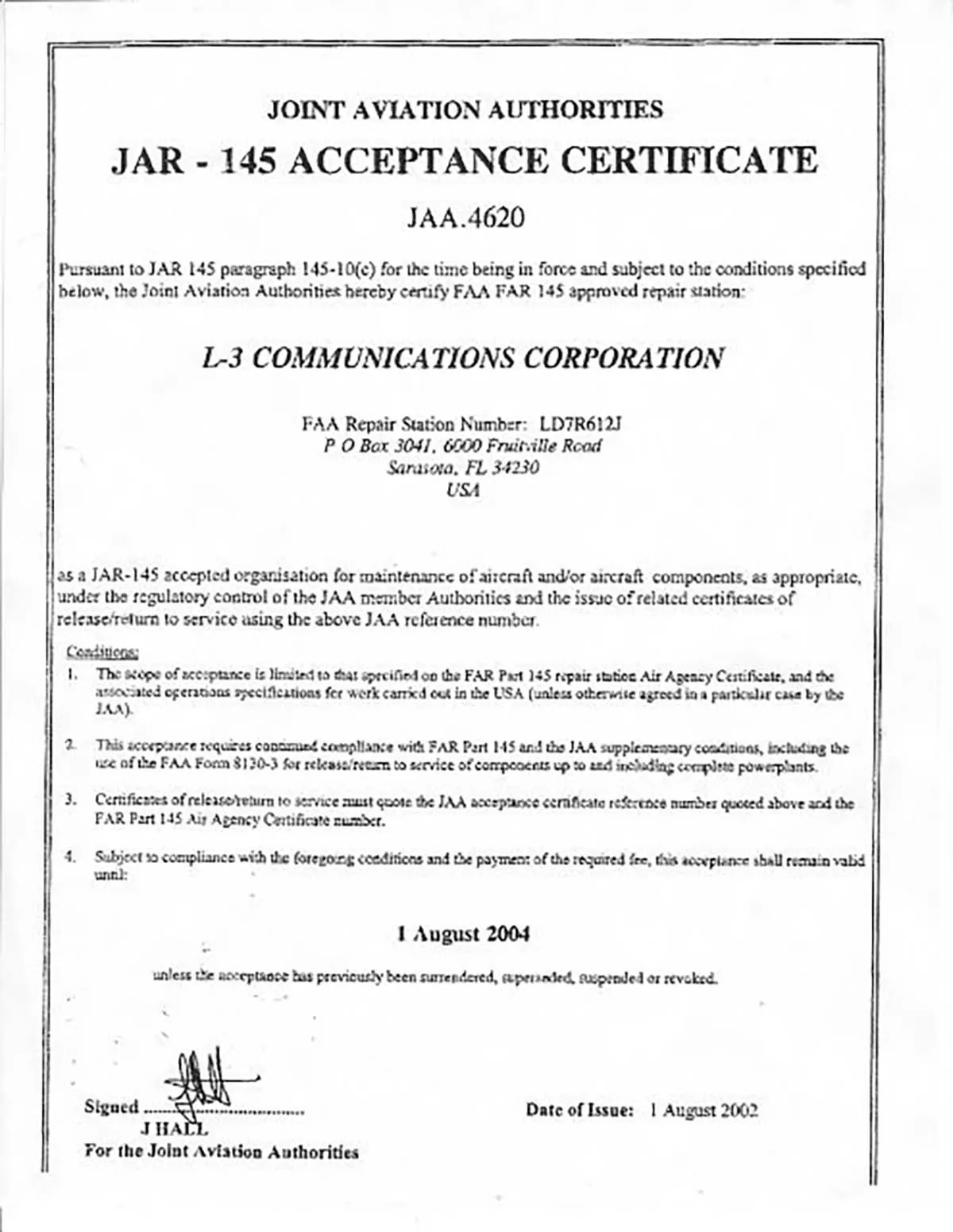

Technical Acceptance

The buyer issues a technical assistance letter requesting any repair of problems by the seller. At this point, you can reject the aircraft.

Closing Documents

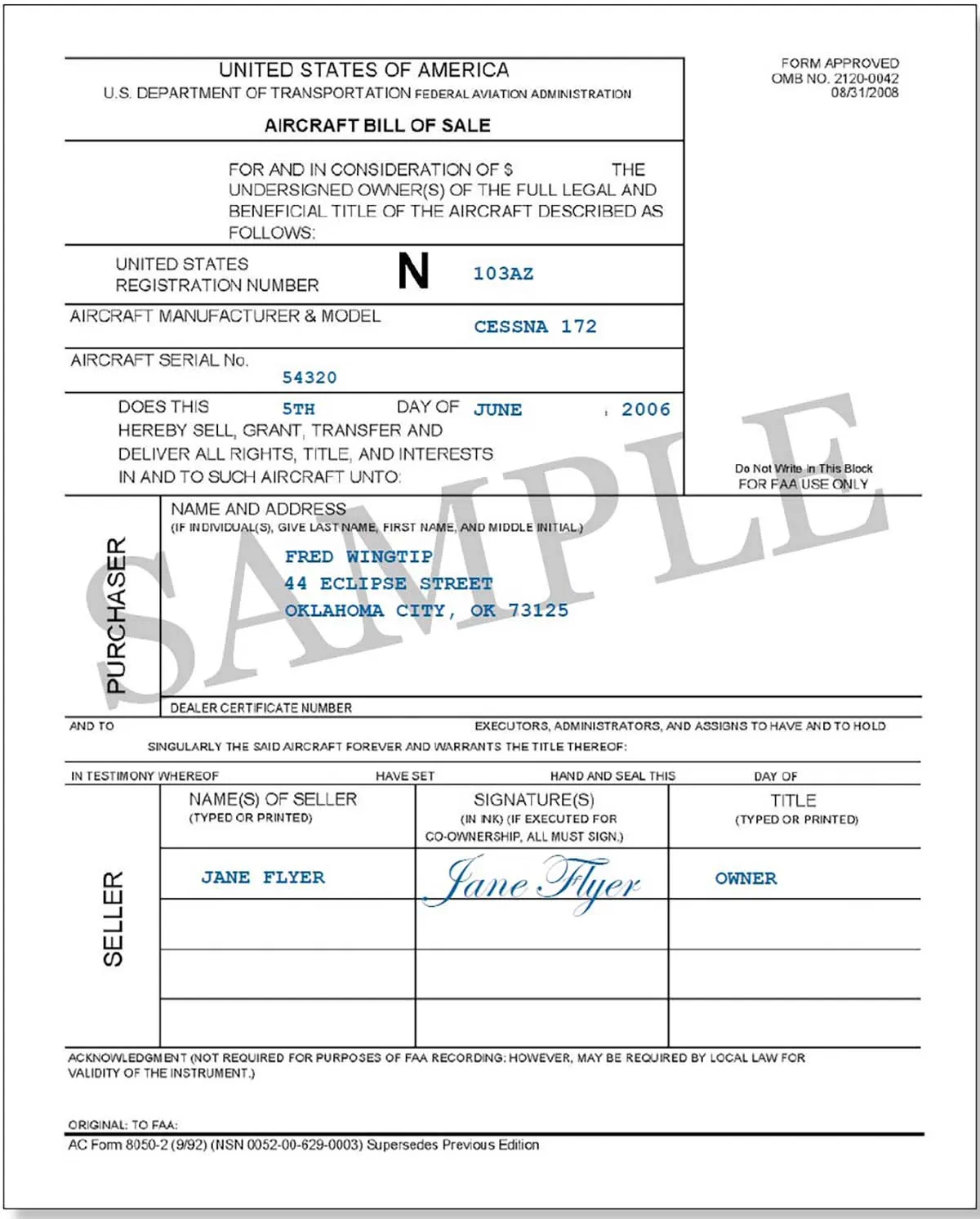

These are various documents exchanged at the closing. For example, this is a sample Bill of Sale.

FAA Regulations

The FAA has regulations for registering your aircraft. It once offered an Aviation Insurance Program.

Registering Your Airplane

You can perform a U.S. Registration if you haven’t registered the aircraft in another country. To be eligible, the owner must be one of the following:

- A U.S. citizen or legal resident, or

- A partnership owned by U.S. citizens, or

- A U.S. organized corporation or association. The president and 2/3 of directors/managers must be U.S. citizens. Also, 75% of voting interests must belong to U.S. citizens, or

- A U.S. government entity, or

- A non-U.S. citizen corporation operating organized in the U.S. At least 60% of flight hours must come from flights taking off and landing in the U.S.

You must register the aircraft in the owner’s legal name. You should send the following documents to an FAA Aircraft Registration Branch:

- Form AC 8050-1, Aircraft Registration Form

- Bill of Sale

- A $5 fee

Each owner must indicate their position and title.

Insuring Your Airplane

The FAA offered its Aviation Insurance Program (AIP) to supplement the offerings of the commercial insurance market. However, the program expired at the end of 2018.

Of course, you can purchase commercial aircraft insurance from many providers. The insurance covers your aircraft against property damage, but also provides liability coverage. Insurance exists for every type of aircraft. Clearly, you need aviation insurance against lawsuits and claims arising from your ownership of aircraft.

Indeed, standard commercial liability insurance doesn’t cover aircraft. You can also buy excess and/or third-party aircraft liability. The insurance protects you against the costs of medical payments and physical damage.

Note that aircraft insurance policies don’t conform to a single standard. Each issuer offers policies that may amalgamate various coverages. For example, these include:

- Land-based general liability

- Airport liability

- Aircraft products liability

- Hanger keepers liability and indemnification

- Personal items of passengers

- Injuries incurred during aircraft operation

- Emergency landing costs

- Search and rescue costs

Of course, policies offer different amounts of coverage depending on whether you use the aircraft personally versus commercially. For example, a flight instruction company will need insurance for flight training services. A lessor may require insurance for its corporate jet fleet.

Aircraft Acquisition and Financing FAQs

Where should I look to buy an airplane?

You can pursue several avenues for aircraft acquisition. For instance, you can go through an aircraft sales company or an aircraft brokerage. You’ll also find many aircraft for sale on the internet. Of course, whether you wish to purchase a new or used jet, Assets America® can assist with the purchase.

What is an aircraft data acquisition system?

It is a system the gathers a multitude of digital and analog signals from an aircraft avionic system and sensors. Then, the system forwards the signals to a flight data recorder and possibly a quick access recorder.

Should I seek professional help for aircraft acquisition?

Unless you are an expert at aviation, aviation law, and aviation finance, you will certainly benefit from professional help. Aircraft acquisition involves a swirl of details on many fronts, so one mistake can cost you dearly. Certainly, the fees you pay for help will pale against the money you could lose by going it alone.

Resources

- Review this checklist of aircraft acquisition planning from Conklin and de Decker.

- Follow the latest news in aircraft acquisition and general aviation at Aviation International News.

- Brush up on your aircraft acquisition terms using this helpful aviation glossary from AirFinance Journal.

- Review these accounting guidelines for aircraft acquisition from the International Air Transport Association.

- Check out this great Aircraft Purchase Guide or this Breakdown for Airplane Hangar Costs from Mototok.