C&I Loans

Assets America® is a top provider of commercial real estate loans (CRE loans), but we also offer Commercial and Industrial Loans (C&I loans) starting at $10 million.

C&I loans are for businesses rather than individuals. They provide funds for capital expenditures, working capital and other legitimate business financing requirements. C&I loans are usually backed by non-real-estate collateral. In most cases, they provide short-term financing.

In this ultimate guide, we cover:

- CRE Loans vs C&I Loans

- Pros and Cons

- Types of Lenders

- Types of C&I Loans

- Online Resources

- Glossary of C&I Lending Terms

- Related Articles

- How Assets America Can Help

Assets America® Offers C&I Loans

We invite you to contact us today to explore a competitively priced C&I loan. Whether you need working capital, new equipment, or some other requirement, we will be happy to work with you. We can do C&I financing up to 100% LTV; this depends of course on your financial qualifications and the age of the asset! Call us today at (206) 622-3000, or simply fill out the below form for a prompt response!

Apply For Financing

The Differences Between CRE Loans and C&I Loans

CRE loans and C&I loans have in common the fact that they are made to businesses. But there are several differences between the two.

Commercial Real Estate Loans

CRE loans are for real estate, typically to build/acquire income-generating properties such as hotels, apartment buildings (multifamily), office buildings, and retail stores (shopping centers). The volatility of real estate makes CRE loans somewhat more difficult to obtain than C&I loans.

Both commercial real estate loans and C&I loans can overlap, as when equity from refinancing an existing asset loan (a C&I loan) funds a rental-property investment (a commercial real estate loan transaction).

Commercial real estate loans have these characteristics:

- They are exclusively for the acquisition, refinance, and construction of commercial real estate.

- CRE loans typically have lower LTV values than home mortgages.

- Commercial Real Estate loans are often adjustable rate or include balloon payments.

- CRE Loans can extract equity from an existing property for additional real estate investments.

- Commercial real estate short-term loans are typically replaced by mini-perm and takeout loans (permanent commercial loans).

C&I Loans

Commercial and Industrial loans are applicable to numerous business sectors. For example, these include:

- Retailers

- Manufacturers

- Industrial companies

- Professional firms

- Health-care providers

- Hospitality companies (hotels, motels, etc.)

C&I loans also have these characteristics:

- Loans are for capital expenses and operations, such as hiring workers, filling seasonal revenue gaps or purchasing equipment.

- C&I loans may be used for construction activity (but are not collateralized by real estate), although commercial real estate loans are more appropriate for this purpose.

- C&I loans are typically not secured by real estate collateral but may be secured by other assets such as equipment, accounts receivable or future credit card receipts.

- Unsecured C&I loans may require a blanket lien that exposes the assets of the business owner to legal claims upon default.

- C&I lenders, lacking the backing of real estate collateral, must closely monitor borrower cash flows and operations, looking at financial ratios like receivables aging and inventory turnover.

- Commercial and Industrial loans may be lump sums or revolving lines of credit.

- C&I short-term loans are frequently granted without the expectation of eventual replacement by a takeout loan, such as in commercial real estate loans.

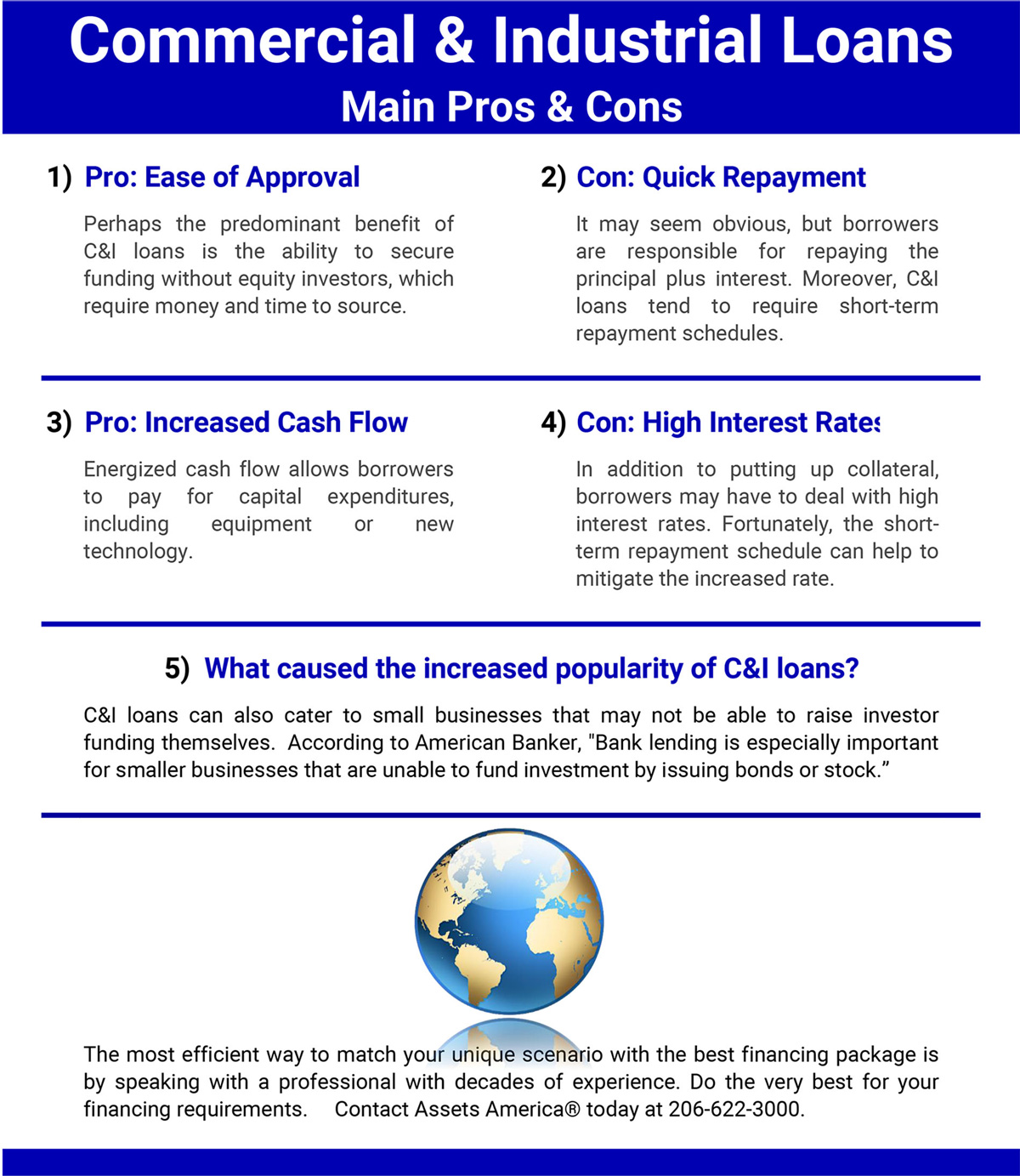

Commercial & Industrial Loans – Pros & Cons

Bank vs Non-Bank Lenders

In 2016, the Federal Reserve began to report that C&I non-bank lenders were taking C&I loan market share away from traditional banks. The basic reason is that C&I non-bank loans are often easier to obtain. C&I non-bank lenders include commercial lenders such as large private money funds, pension funds, insurance companies, and other institutions.

Non-bank C&I lenders can fund commercial and industrial loans that many typical banks cannot fund due to federal bank regulations. These lenders avoid the often cumbersome rules and regulations that FDIC insured banks must follow in most cases.

For example, non-bank lenders enjoy non-price advantages including credit-line limits, loan covenants, maximum maturity, and collateral requirements.

Another dynamic is risk tolerance. Banks have reserve requirements that limit their ability to assume risk, a factor that is less stringent to nonbank C&I lenders. Asset America® can often provide easier access to funding due to our numerous funding sources, lender relationships, and expert financial package submissions.

Types of C&I Loans

There are at least six types of C&I loans:

- Secured and Unsecured Term Loans

- Asset-Based

- Leasing & Equipment Finance

- Small Business Administration

- Merchant Advances

- Factoring

These C&I loan types vary in several dimensions, including term, pricing, structure and monitoring. Assets America® is proud to participate in the C&I market.

1. Secured and Unsecured C&I Term Loans

Short term commercial and industrial loans are typically one to two years. The interest rate may be tied to an index such as LIBOR (London Interbank Offering Rate) or the prime rate, especially if the lender is a bank. However, a non-bank C&I lender may use a different fee structure or different index altogether.

Unsecured short-term C&I loans are granted based on the creditworthiness of the business borrower. Lenders assess cash flows and the business’ cash conversion cycle to verify that the borrower can make the periodic payments.

Secured C&I loans are collateralized by non-real-estate assets of the business. The lender might require a blanket lien that uses personal collateral belonging to the business owners or directors, should a default occur. For a blanket lien to be effective, however, C&I lenders must closely monitor the owners/directors and stand ready to quickly seize and liquidate collateral, if the need arises.

2. Asset-Based C&I Loans

Asset-based loans are short-term. Assets such as inventory and accounts receivable serve as collateral. Lenders must monitor the quality of the collateral. For example, as inventory ages it may become obsolete, damaged or stolen. Receivables that slip beyond 90 days past due might have to be written off. Lenders set a fixed percentage of the underlying assets that serve as collateral to accommodate valuation risk.

3. C&I Leasing/Equipment Finance

Leasing with a bargain purchase option is an alternative way for a business to buy equipment, vehicles and other assets when the lease term has expired. The lease residual value is often low or zero. In general, interest rates are higher than those for C&I term loans, but monthly payments are lower. The equipment under lease is the collateral, which is subject to repossession if a default occurs.

4. Small Business Administration C&I Loan Guarantees

The SBA offers loan guarantees for businesses that would otherwise have trouble qualifying for a loan. SBA loan programs cover both commercial real estate loans and C&I loans. Although the SBA programs widen access to financing, they can be more complex and time-consuming.

Video: SBA Loans for Businesses Explained

5. C&I Merchant Cash Advances

These are upfront payments predicated upon future credit card receivables, which in turn repay the advance. The commercial and industrial loan lender deducts the loan payments from the credit card payments and forwards the remainder to the borrower.

6. C&I Factoring

Factors provide funding based upon unpaid customer invoices or accounts receivable. The factors might purchase the invoices from the business or might advance a loan to cover a portion of the invoices.

C&I Loan Glossary

| Term | Definition |

|---|---|

| Acre | A parcel of land measuring 43,560 square feet (can be any shape); for reference, a football field is 1.32 acres of land |

| Square Acre | A parcel of land measuring 208.71 feet on each side (a square) |

| Adequate Truck Turnaround | A term used to denote the amount of space necessary for semi-trucks to smoothly load and unload in succession |

| Blanket Loan | A kind of loan that covers multiple pieces of real estate mortgaged to a single individual or entity |

| Butler-Type Building | A kind of pre-engineered and pre-fabricated building often used on commercial and industrial sites |

| DSCR (Debt Service Coverage Ratio) | Also called the "debt coverage ratio" (DCR), it is the ratio of cash available for debt servicing to interest, principal, and lease payments |

| Defeasance Process | A means by which borrowers can get out of a mortgage by substituting a portfolio of U.S. Treasury-backed securities for collateral |

| Exit Strategy | The method by which a venture capitalist or business owner intends to get out of an debt or loan |

| Light Industrial | Refers to a type of industrial property wherein the day-to-day processes involve minimal heavy-duty usage; common uses include warehousing and storage, utility plants, and distribution centers |

| Line of Credit (LOC) | Also called revolving credit, an LOC is an amount of money extended from the lender to the borrower |

| Max LTV | Denotes the maximum loan-to-value ratio that a lender is willing to agree to lend |

| Total General Expenses | The combination of expenses, including rent, repairs & improvements, property taxes, real estate and other professional fees, payroll, etc. |

| Total Capital Items | The combination of all capital expenses for a single property, whether for construction, demolition, or any other kind of development |

| Trailing Basis | Referring to a recently completed time period. For example, trailing 18-month earnings refers to a company's earnings over the 18 months ending on the last day of the most recent month |

Online Resources

- First, check out this fact report on United States Commercial and Industrial Loans from Trading Economics for up-to-date and expertly curated market analysis.

- Additionally, you can also use this 2018 Market Report for C&I Strategy by Paynet, a leading provider of small business credit data and analysis.

- FRED Economic Data also publishes economic research from the Federal Reserve Bank, including statistics on Commercial and Industrial Loans.

- Every year the Conference of State Bank Supervisors (CSBS) also publishes a spotlight report on C&I Lending. For example, check out the 2017 Spotlight – Recent Trends in Commercial & Industrial Lending.

- Finally, you may also find this Commercial Mortgage Calculator useful.

Related Articles

- Complete Guide to Industrial Gross Leases

- Adaptive Reuse of Industrial Buildings – 7 Brilliant Ideas

- Industrial Areas: Step-By-Step Financing Guide

- Ultimate Guide to Industrial Park Financing