Construction

Loans

Procuring large commercial construction loans is extremely difficult, time-consuming, complex, tedious, and requires a high-level of expertise and experience. But we absolutely love them! Assets America® is one of very few commercial lenders that has the knowledge and background to arrange substantial commercial construction loans and construction financing. Our loans start at a minimum of $30 million, with virtually no upper limit.

Commercial Construction Lenders

One of the distinguishing characteristics of commercial building construction is that the physical building has not yet been constructed. In other words, the full and final collateral does not exist yet. Therefore, the lender makes only partial construction loan disbursements. Of course, the lender monitors these disbursements very carefully. Prior to the release of subsequent construction disbursements, the construction lender verifies that the borrower properly used the last disbursement for the intended construction expenses. The lender also checks that the borrower submitted all lien waivers. Our construction funding sources consider many factors when underwriting a commercial construction loan, including the developer’s track record, the proposed development’s proforma, and so forth.

It takes a high-end brokerage with decades of experience, like Assets America®, to handle the extremely detailed and complex documentation. Importantly, this is essential for the approval and funding of high-end commercial construction loans.

Purposes and Types of Commercial Construction Loans

Different types of commercial construction loans are available for a variety of purposes.

Purposes

Commercial construction loans enable borrowers to build new commercial properties. They can also reconstruct, rehabilitate or upgrade existing commercial properties. If you scroll through the Lines of Business dropdown menu (above), you’ll see the numerous applications for commercial construction loans. They include:

- Multifamily Loans

- Office Building Loans

- Hotel Financing

- Hospital Building Loans

- Mixed-Use Development Loans

- Industrial Park Loans

- Master Planned Community Loans

- Several more

How Assets America® Can Help

In conclusion, if you are interested in multifamily development, mixed-use development, hospital building, industrial construction, hotel construction, or any other commercial building loan, we are one of the finest choices you could possibly make for successfully closing your construction loan. To arrange for your commercial construction loan starting at $20 million, contact us today at (206) 622-3000, or simply fill out the below form for a prompt response!

Apply For Financing

Do you need commercial property loans in excess of $20 million with excellent construction loan interest rates? Assets America® has the professional expertise and network of funding sources to arrange the financing you require.

Types of Commercial Construction Loans

Commercial construction loans can be categorized by type, as follows:

- Land Development Loans: These are risky loans in that raw land will only collateralize a small percentage of the value of developed land. Therefore, borrowers often need to provide additional assets as collateral. Lenders look for developers with solid track records before granting this type of loan. You can use loan proceeds to clear land, install infrastructure (i.e., water, sewer, power), subdivide the land, and so forth.

- Acquisition & Development Loans: These loans cover the purchase cost and subsequent development of raw or partially developed land. Proceeds apply to any necessary improvements before new construction begins.

- New Construction Loans: These are short-term loans, usually interest-only. The term is commonly up to 18 months, but the lender might grant extensions to cover additional fees. Construction loans can be set up as revolving credit lines to fund separate construction loan stages or separate properties in a multi-phased construction project.

- Bridge Loans: In some situations, a developer needs construction funding while they still owe money on a previous project that has not yet sold. A bridge loan is for this circumstance. The loan may require a lien on the for-sale property to act as collateral for the loan. When the construction is rehabilitation rather than new construction, the existing property can also serve as collateral. Bridge loans are also temporary. Terms are usually for a year or less, though longer terms can be negotiable.

Types of Commercial Construction Loans (Continued)

- Mini-Perm Loans: Mini-perm loans are also temporary loans. They typically follow the completion of a construction project and the issuance of a Certificate of Occupancy for the new building. A mini-perm loan settles any remaining balance on a construction loan. It remains in place as the property stabilizes and generates income, usually for a period of two to three years beyond the initial construction loan.

- Takeout Loans: A takeout loan is a permanent mortgage on a commercial construction project that replaces the relatively short-term financing, such as a mini-perm loan. Assets America® can provide a flow of financing from commercial construction loan through mini-perm loan to takeout loan in a seamless and uninterrupted sequence.

- Mezzanine Loans: Mezzanine loans are a mechanism to add financing to an existing construction project. It adds debt to the capital stack through subordinated debt that increases the borrower’s leverage. For example, a mezzanine loan might increase the borrowers leverage from a 70% loan-to-cost (“LTC”) to an 85% LTC. Mezzanine loans typically charge higher interest rates and may have additional restrictive terms.

How Do Commercial Construction Loans Work?

Assets America® fully understands the unique characteristics of short-term commercial construction loans, along with their many moving parts and complex deal structures. Our firm understands the needs of both our borrowers and our funding sources. This helps us to negotiate the best overall loan terms for our clients. Terms include the maximum leverage the borrower can obtain, interest rate, repayment terms, and many other factors.

By loan closing, Assets America® will have negotiated critical understandings. Examples include property insurance and the construction contract between the developer and lender. The contract specifies how the developer can draw loan funds, subject to the architect’s sign-offs and lien waivers. The contract commits both sides to complete the project, under the terms of the contract. The end goal is the receipt of the Certificate of Occupancy (CoO), which satisfies the borrower’s requirement for the last loan installment and the lender’s requirement for sufficient collateral to protect its investment. It’s only after the CoO is issued and the property is leased to stabilization (typically 95% leased) that the property reaches its full liquidation value for purposes of collateral.

What are the Requirements for a Construction Loan?

Banks are typically the primary source of commercial construction loans. They underwrite these loans by examining a large number of data points, including project metrics and the documentation. Usually, the representative brokerage firm prepares the borrower’s documentation. The lender must weigh a host of factors. For example, these include:

- The project’s most current proforma just prior to loan submission

- Local market conditions

- The construction budget

- The history of the development team

- The financial capacity of the loan guarantors

Of course, any special project-specific risks undergo careful review and consideration.

Metrics for Commercial Construction Loan Underwriting

Lenders underwrite commercial construction loans using a variety of information. For example, important metrics include:

- Loan-to-Cost Ratio: The LTC ratio equals the commercial construction loan amount divided by estimated total project cost. Typically, commercial construction loans have an LTC between 70% and 90%. The remainder of the funding comes from the borrower’s equity.

- Loan-to-Value Ratio: The LTV ratio equals the fully disbursed construction loan amount divided by the estimated value of the property when complete. This value is usually close to 70% but can be higher for SBA-guaranteed loans.

- Debt Service Coverage Ratio: DSCR equals the proforma net operating income of a proposed property divided by the estimated annual interest and principal payments on the permanent takeout loan (not the commercial construction loan, which is an interest-only loan). Typical DSCR values for commercial construction loans can exceed 1.25.

- Profit Ratio: The projected profit ratio equals the completed property’s estimated profit divided by the estimated total cost. Lenders typically desire a projected profit ratio of 20% or greater. Lenders requires a decent profit ratio to have confidence that the borrower has sufficient motivation to complete the project.

- Net Worth to Loan-Size Ratio: This ratio is the developer’s net worth divided by the commercial construction loan amount. Look for a value greater equal to or greater than 1.00, since a lower value would mean the developer had insufficient resources to cover the loan in the event of default.

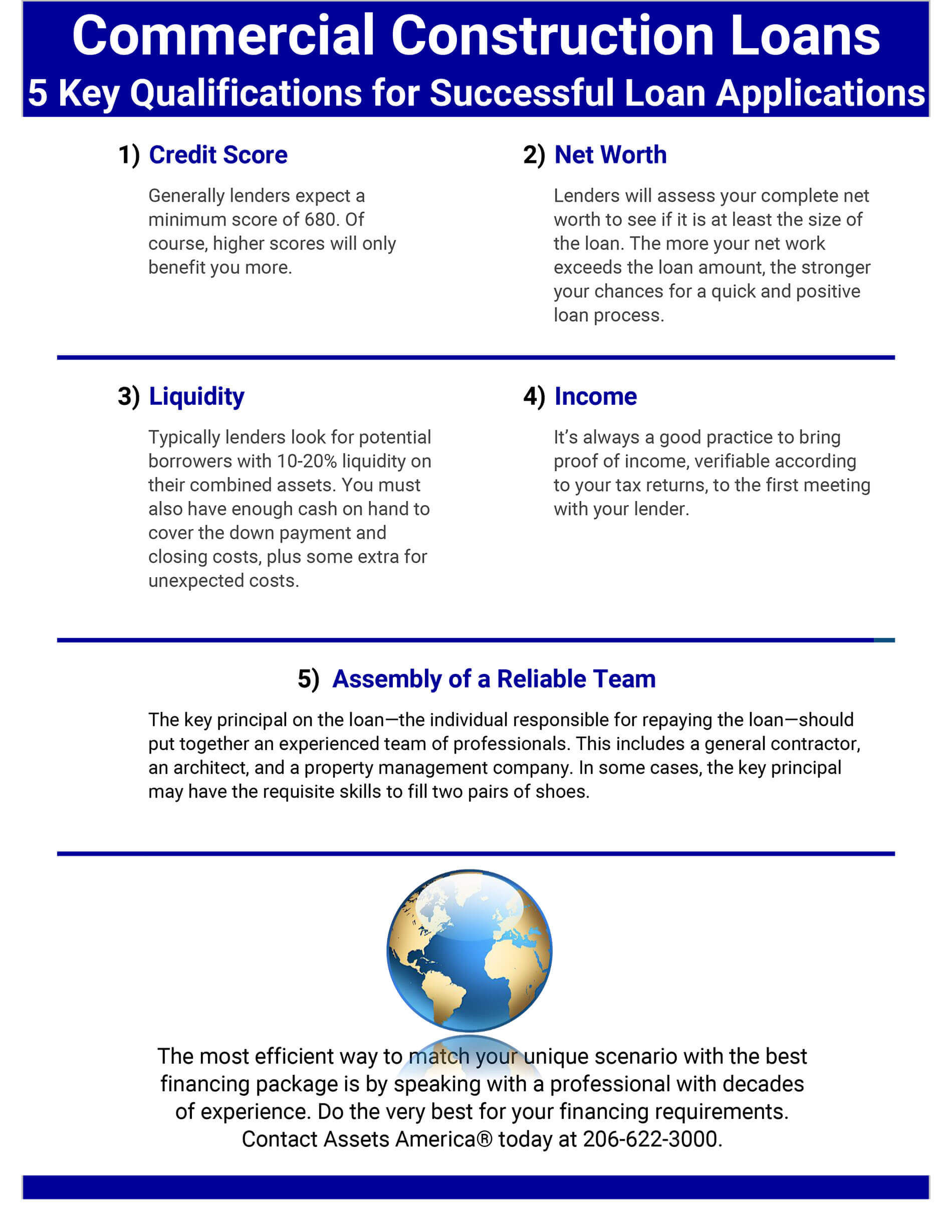

Infographic: 5 Key Qualifications for Successful Construction Loan Applications

Documentation

Putting together a loan application for commercial construction financing requires far more than just filling out a form. The borrower, working with its professional representative, also needs to assemble and present full documentation. For example, these include:

- Business plan

- Earnings projections

- Contractor’s estimates

- Financial documents, both personal and business

A business plan contains enormous amounts of technical and financial data. For example, these include:

- Site location

- Property type (retail, residential, mixed-use, etc.)

- Feasibility studies

- Building size

- Number of stories

- Unit sizes

- Mechanical plans (plumbing, electrical, ventilation, floor plans, finish standards, etc.)

- Amenities

- Parking

- Signage

Commercial Loan Agreements

If a borrower and lender agree on commercial construction financing terms, they sign a loan agreement, memorializing all of the terms. The agreement includes a disbursement schedule. Specifically, this schedule specifies how and when loan funds become available to the borrower. It also includes a discussion of how to handle change orders.

Lenders often require loan-in-balance (LiB) provisions requiring that the unfunded loan is sufficient to cover the costs to complete the project. In other words, the provisions help ensure that the loan remains in balance. A loan agreement’s LiB provisions discuss the hard and soft costs of the project, plus the project’s allocated equity and secondary loan resources. Often, the commercial construction budget includes a contingency account for when costs change in order to maintain the loan’s balance. Change orders are a common contingency that often arise during a commercial construction project. If the commercial construction loan becomes significantly unbalanced, an LiB provision might allow the lender to place the loan into default status.

Video: Commercial Real Estate Loan Refinancing

Sources of Commercial Construction Loans

Banks and credit unions are the primary sources of commercial construction loans. They typically offer the best interest rates, but they also have some of the most stringent underwriting standards. Other sources include private lenders, the commercial mortgage-backed securities market, and life insurance companies.

The Small Business Administration’s CDC/SBA 504 loan program is available for the construction of owner-occupied commercial real estate. For example, the loan amounts can reach $14 million, with interest rates around 5% and terms from 10 to 20 years.

Common Terminology for Commercial Construction Loans

| Term | Definition |

|---|---|

| Balloon Mortgage | A short-term loan with fixed-rate monthly payments that last a specific number of years, followed by a large “balloon” payment for the balance |

| Commercial Mortgage Securities | A type of mortgage-backed security that is secured by the loan on a commercial property |

| Defeasance Process | A process wherein the borrower substitutes U.S. Treasury-backed securities for collateral in order to exit a mortgage before maturation |

| Lien | A legal right that guarantees an underlying obligation, for example repayment of a loan |

| Loan Guarantor | An entity or individual who guarantees to pay for loan debt if the principal borrower should default on a loan obligation |

| Loss Mitigation | A process wherein the lender helps the borrowers avoid foreclosure after defaulting on a loan |

| Origination Fee | An upfront fee charged by a lender for processing a new loan application |

| Private Mortgage Insurance | A kind of insurance the borrower pays, especially when the borrower is unable or unwilling to put down 20%, in order to protect the lender |

| Pro Forma | A method for calculating and displaying financial results to emphasize either current or projected figures, chiefly used to determine the viability of an investment during the loan process |

| Rate Lock | Also called rate protection, this prevents the loan interest rate from changing during the interim after applying for the loan, but before closing the loan |

| Revolving Credit | Credit that is automatically renewed as debts are paid off |

Online Resources

- First, for market intelligence and reports, check out the Commercial Construction – US Market Report from IBIS World or the Commercial Construction Index from the US Chamber of Commerce .

- Secondly, there are several high-quality blogs providing news and information for those involved in commercial construction, including AEC Business , CC&R Magazine , and Construction Executive .

- In addition, Best Practices Construction Law is an excellent resource for understanding commercial construction litigation and legality issues.

- Finally, the Commercial Construction Loan Calculator provides a complete breakdown for the repayment process.

Assets America® Provides Commercial Construction Loans

Count on Assets America® for all your commercial financing, including commercial construction, bridge loans, mini-perm loans and takeout loans. For the highest level of continuity, we can arrange the sequence from commercial construction loan to mini-perm loan to takeout loan.

Finally, Assets America® is one of the most professional and diligent construction loan lenders in the marketplace. You will also find that we have the specialized knowledge and technical skills required to assemble your detailed commercial property loan documentation. Of course, the same is true for funding and securing exceptional commercial real estate loans.

Related Articles