Mergers and

Acquisitions

Assets America® can facilitate and fund your Mergers and Acquisitions (M&A) transactions. We work with our extensive network of financial and legal associates to cover all aspects of private M&A financing, with deal sizes starting at $20 million. Our network of acquisition and mergers funding sources and advisors provides M&A finance, consulting, and support for M&A processes. In this article, we cover:

- What is “Merger and Acquisition”?

- The M&A Process

- Smart Strategies

- Important Concepts and Variations

- Types of Transactions

- Financing Structures

- Funding Sources

- 5 Signs of a Healthy Merger (Infographic)

- Glossary of Important Terms

- Helpful Online Resources

- How Assets America Can Help

Video – Mergers and Acquisitions: The World’s Best Lecture in a Nutshell

What Is M&A?

The basic M&A definition is the combination of two separate companies. In some cases, it’s a combination of equals, but it often involves an acquirer taking over a target company. M&A encompasses many variations, including mergers, acquisitions, consolidations, reverse takeovers, and triangular mergers. Many factors apply to M&A transactions, including friendly vs hostile transactions and public vs private deals. Often M&A transactions are efficient because the combined entity often sheds redundant employees and assets. Other benefits include economies of scale, acquisition of new technologies, and improved market position.

Assets America® Can Secure Your Mergers and Acquisitions Funding

Contact Assets America® to finance your next M&A transaction. We can provide fantastic M&A finance terms even when your funding source rejects your request. We also work with a network of professionals to handle all the financial, legal and valuation issues surrounding M&A transactions. Therefore, if you need top service, unparalleled professionalism and surety of execution, turn to Assets America®. Call us today at (206) 622-3000 for M&A deal structuring and a deep source of M&A finance, or simply fill out one of the below forms (Buyer or Seller Intake Questionnaire) for a prompt response!

Please Fill-In our Buyer or Seller Intake Form

Buyer Intake Questionnaire or Seller Intake Questionnaire

Important Concepts and Variations

Mergers

A merger is the combination of two firms of approximately the same size, also known as a “merger of equals”. Sometimes, one of the existing companies continues to exist as a combination of both merger partners. In a consolidation merger, the partners form a new company, and the previous companies cease to exist. The M&A transaction usually involves the surrender of each company’s stock and replacing it with shares of the new company. Mergers are always friendly, and they typically include the support of both companies’ directors.

Acquisitions

In an acquisition, one company (the acquirer) clearly attempts to take over another company (the target). It might be a friendly Mergers and Acquisitions transaction, but it is often a hostile transaction. If the acquisition is successful, the target company ceases to exist, and the acquirer assimilates its assets. The acquirer may sell parts of the target company as part of the transaction, sometimes to meet regulatory requirements. In other cases, the target company may become a division of the acquirer, or the acquirer may absorb the target’s assets into existing operations.

Reverse Takeover

Normally, in an acquisition, the acquirer is larger than the target. However, in a reverse takeover, the target is the larger company. Sometimes, one company is public and the other is private. If the acquirer is public, they takeover the private company by an issue of shares and an asset transfer. If the acquirer is private, a reverse target lets it publicly float its shares without the cost and delay of an initial public offering (IPO). Sometimes, the target is a publicly listed shell company with limited assets. This is a quick way to take a public company private. Private shareholders usually effectuate the reverse takeover by contributing their shares to the target shell company. That’s the gist of “What is a reverse takeover?”.

Triangular Merger

Triangular mergers help reduce taxes from the merger. In a forward triangular merger, the target company merges into a shell company that the acquirer owns completely. In effect, the target becomes a subsidiary of the acquirer. The taxes on a forward triangular merger are handled as if the target sold the shell company its assets and the target was then liquidated.

In a reverse triangular merger, also called a backflip takeover, the subsidiary merges into the target company. In this M&A transaction, taxes are assessed as if the target’s stockholders sold their shares to the acquirer.

Friendly vs Hostile Takeover

In a friendly takeover, the acquirer and target agree to terms of the M&A combination, including the purchase price and the method payment. For example, payment methods include cash, debt or shares. The directors, employees and shareholders support the deal in the belief that it advances their interests. On the contrary, an acquirer attempts a hostile takeover over the objections of the target company’s board of directors. The bidder tenders an offer to purchase the target composed of cash, stock or some combination thereof. The bidder might also engage in a proxy fight to take control of the target’s board. The target might look for a bid from another company, called a white knight, and/or adopt one or more “poison-pill” provisions to make the hostile takeover costlier to the bidder. A corporation’s board of directors uses the poison-pill defensive tactic in hopes of preventing a takeover.

Public vs Private

In a public takeover, the acquirer and target are public companies. The acquirer tries to gather a majority of shares from existing shareholders. A private takeover usually involves a private acquirer taking over a private or public company. Private takeovers usually involve the acquirer’s private shares, cash and/or debt. For example, the acquirer might pay for the private takeover with private bonds issued to the target’s shareholders.

Types of Mergers and Acquisition Transactions

Assets America can complete all sorts of M&A transactions, including the following:

Functional

What characterizes mergers is the relationship between the two merging companies. For example, these include:

- Horizontal: The two companies directly compete with each other, having similar markets and product lines.

- Vertical: This is a merger between a company and its supplier or customer.

- Conglomerate: The two merging companies do not share any areas of business.

- Market extension: This is two companies that market the same products, but in different markets.

- Product extension: This is two companies selling related products in the same markets.

Outcomes

The two basic outcomes are:

- Statutory: In a statutory merger, one of the parties retains its identity as an entity while the other loses its identity.

- Consolidated: In a consolidated merger, both parties lose their identities, which are replaced by a new entity with a new identity.

Arm’s Length Mergers

In this type of merger, the target and acquirer deal through an independent third party. This ensures that neither the target nor the acquirer can influence each other directly. An arm’s length merger helps to quell controversies, such as the valuation of the target company.

Strategic Mergers

In a strategic merger, the acquirer makes a long-term commitment to create synergies with the target company. These synergies include broadening the customer base, increasing market share, and strengthening the overall business. The acquirer might be willing to pay a premium for the target if it envisions synergies arising from this M&A transaction.

Acqui-Hire

In an acqui-hire M&A transaction, the acquirer is more interested in the target’s employee talent pool than in the target’s product lines. For example, this type of Mergers and Acquisitions deal is popular in the technology sector where expertise is at a premium.

M&A Finance

There are numerous ways to finance an M&A transaction. Assets America® will help to secure the very best marketplace financing terms for your deal:

Cash

In an all-cash M&A transaction, the acquirer pays for the target company with cash. The cash may come from retained earnings, debt, or stock issuance. Often, cash plays a role in acquisitions rather than mergers, as shareholders in the target company exit the picture when they tender their shares for cash. Cash is considered the strongest form of financing because it has a fixed value. However, it does trigger capital gains taxes for target shareholders.

Debt

When debt finances the M&A transaction, the target shareholders exchange their stock for debt instruments. This helps the acquirer conserve cash and postpones taxation for the target shareholders because the tax rolls over. The acquirer increases its indebtedness, possibly reduces its bond rating, and increases its cost of debt.

Stock

The target shareholders accept shares of the target company, often with a cash sweetener, in return for their own shares. This stock swap postpones capital gains taxes until the target shareholders eventually dispose of their acquirer shares. The acquirer sends a signal when paying with stock rather than cash. The signal is that the acquirer considers its shares overvalued. The reverse is true if it prefers to pay with cash.

The acquirer shares can come from two sources:

- Issuance of stock: This involves the creation of new shares, which add to the capital stack. This may improve the acquirer’s debt rating and cost of debt. However, it creates additional costs for documenting the new shares, approving them in a shareholder meeting, and registering the new shares with the SEC. It also increases the acquirer’s cost of equity capital.

- Treasury shares: These are authorized but undistributed shares. They are available to pay target shareholders for their shares. If the acquirer lacks sufficient treasury shares, the company can go into the open market to purchase them.

Mezzanine Capital

Mezzanine capital, typically preferred stock or subordinated debt, can also finance an M&A transaction. Entities usually obtain mezzanine funding through a private placement. This type of capital is more expensive because it is unsecured and ranks above only common stock in access to funds following default and bankruptcy. The additional riskiness of mezzanine capital means that investors require a higher rate of return on it, thereby boosting its cost to the acquirer.

Typically, a private mezzanine specialist firm pays cash for the acquirer’s private preferred shares and/or junior debt. The acquirer then uses the cash to purchase the target company. Alternatively, the acquirer may offer preferred shares and/or subordinated debt to target-company shareholders, especially when the target is private. Often the preferred shares are convertible into common stock, or they may come packaged with common stock warrants. The subordinated debt also might be convertible into common stock.

Leveraged Buyout

In a leveraged buyout (LBO), the acquirer uses a substantial amount of borrowed money to finance the proposed M&A transaction. The assets of the target company serve as collateral to secure the acquirer’s debt. This allows smaller companies to acquire larger, asset-rich targets. LBOs are a popular way to take a public company private. The company buys up the outstanding public shares and assigns them to one or more controlling shareholders.

M&A Funding Sources

Funds for M&A transactions usually come from banks, private equity firms and brokers. However, financing terms are highly situational. For example, factors affecting the financing terms include:

- Cost of the M&A transaction

- Financial strength of the acquirer and target

- Collateral considerations

- Payment type (cash, debt or equity)

- Tax strategies

In smaller M&A transactions, one way to lower the M&A cost is to secure the debt financing with the Small Business Administration’s 7(a) program. This program guarantees up to 75% of M&A loans of up to $5 million. Loan terms can run up to 10 years, and interest rates will cap at prime plus 2.75%. Collateral is optional for SBA approval, but the lender may require it. Borrowers that own at least 20% of the post M&A equity must personally guarantee the loan. Typically, the lender requires a minimum post-transaction fixed charge coverage of 1.15x, which translates to an EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) cash flow of 3-4x the fixed charges. However, some funding sources have more stringent requirements. The SBA charges a loan fee of up to 3%, which cuts into the savings from the reduced interest rate.

SBA 7(a) Program for M&A

Certain rules apply when using the SBA 7(a) program to guarantee debt for an M&A transaction. For example, these rules include:

- The acquirer must purchase 100% of the equity owned by the target shareholders or own 100% of the target’s assets upon completion of the M&A transaction.

- The price of the M&A transaction must also be fixed and firm, without any contingencies that could affect its value.

- The acquirer must have functional control of the post-transaction entity.

- Certain businesses are banned from the 7(a) program, including firearm sellers, multi-level marketers and others.

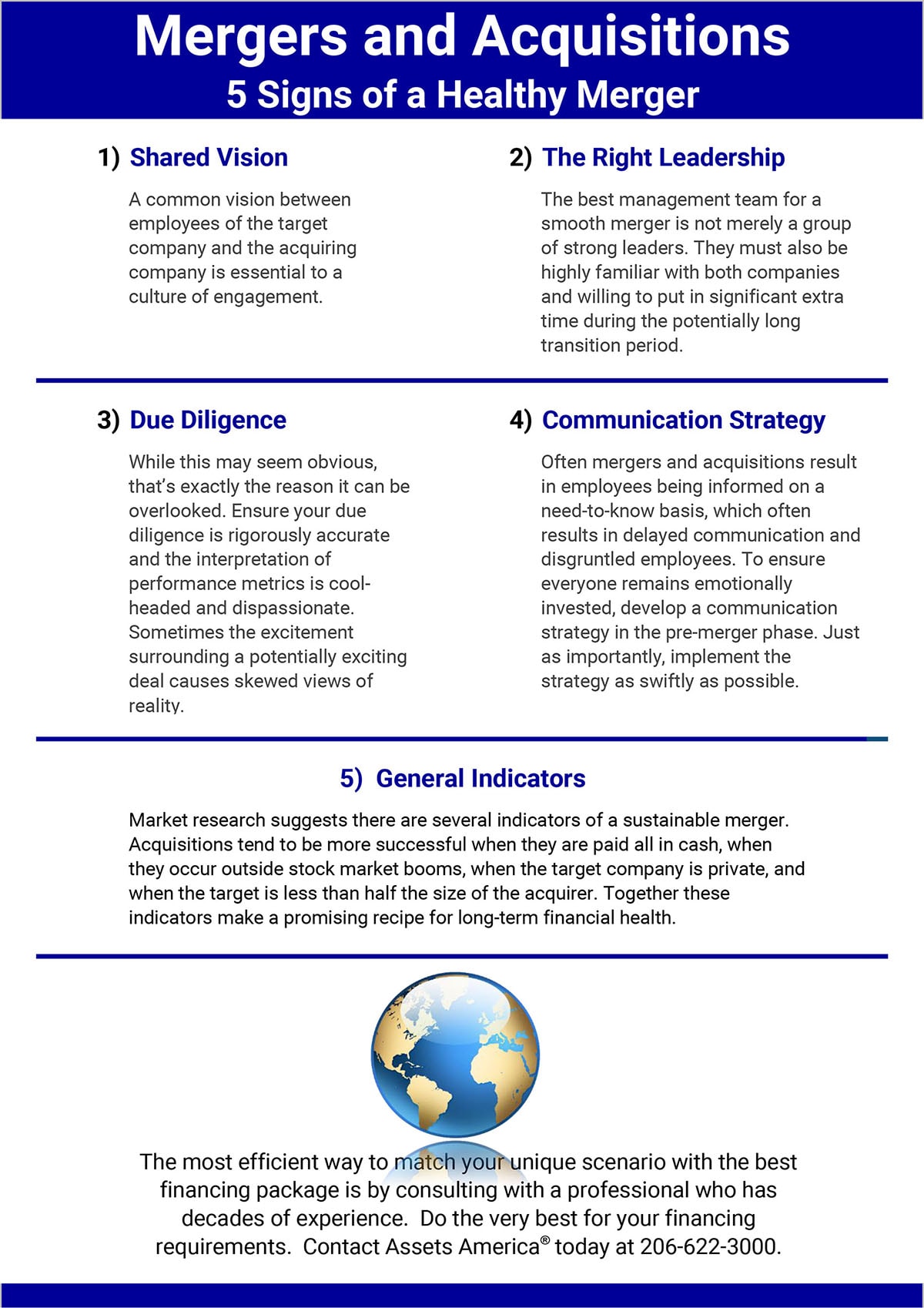

Infographic – Mergers and Acquisitions: 5 Signs of a Healthy Merger

Online Resources for Mergers and Acquisitions

- First, check out the Reuters M&A section or the Bloomberg Mergers section for the latest headlines and updated news.

- Secondly, Mergers & Acquisitions deal-makers utilize online data rooms for due diligence, including Firmex, the Merrill Datasite, and ShareVault.

- In addition, read this Forbes article on how to spot chinks in the armor of a supposedly ironclad deal.

- Finally, read this New York Times article sharing deal tips from Buffet and other HB managers

Mergers and Acquisitions Terminology

| Term | Definition |

|---|---|

| Accretion | An improvement in per share metrics post-transaction (after issuing additional shares); the opposite of dilution |

| Backward Integration | A deal wherein a company acquires a target that produces the raw material or the ancillaries used by the acquirer. Backward integration allows for a continuous supply of fairly-priced materials or ancillaries products |

| Bootstrap Effect | The short-run increase in earnings per share which occurs in a share-for-share exchange when a company trading on a higher price to earnings ratio acquires a company trading on a lower price to earnings ratio |

| Creeping takeover | The gradual acquisition of the controlling interest in a company by buying its shares over a period of time |

| Dilution | A worsening of per share metrics post-transaction (after issuing additional shares); the opposite of accretion |

| Fair Value Adjustments | A change in the net book value of assets to arrive at fair market value |

| Fully Diluted Shares | The total number of shares that would be outstanding if all possible sources of conversion, such as convertible bonds and employee stock options , are exercised |

| Golden parachute | A tactic used to make hostile takeovers more expensive, the golden parachute is an employment contract offered to executives which guarantees to pay extensive benefits in the case that they are dismissed from the company |

| Horizontal Integration | A merger between companies in the same line of business |

| Pro Forma Shares | The number of shares outstanding after closing the transaction and issuing additional equity |

| Vertical Integration | When the acquiring company mergers with a target in its supply chain |

Related Articles