Energy Finance

The pursuit and delivery of energy is of paramount importance to the survival of our civilization, and Assets America® is proud to play its part by arranging energy finance for the full range of technologies and fuels, including solar finance and other energy finance solutions.

The energy industry is a foundational part of the global economy, facilitating everything from the finance of Wall Street to transportation and logistics. With supply chains stretching across the globe and incorporating exploration and production, manufacture and supply as well as companies ranging from large-cap public entities to smaller, private equity-backed start-ups, the energy sector is complex. It is also in a period of significant transformation. Technological innovation, cost pressures and concerns about efficiency and the environment have collided with increased government regulations and incentives to create dramatic changes across the energy industry.

Through all this change, however, one thing has remained constant, the need for businesses to secure energy project financing with substantially beneficial transactional terms and pricing.

The problem energy projects face when securing energy finance is that the loan products and underwriting guidelines used by many funding sources are not suited to the energy project’s unique and specific requirements. Lenders often demand the creation of a relationship whereby the energy lender seeks only to maximize their own profits and place the lion’s share of the risk onto the borrower’s shoulders.

Assets America® does not believe in making energy developers and businesses clamber through administrative obstacle courses to obtain the funding they need to succeed. Assets America® does the legwork, from soup to nuts, to facilitate the most efficient and highly tailored flow of capital from lenders to innovators, to producers to network operators. At Assets America®, we combine energy market knowledge and insight with our expertise in how to secure the best possible financing solution for energy projects across the world. By understanding the specific requirements of your business, we can match you to exactly the right energy funding source to provide incredibly meticulous and detailed, energy transactional processing.

Whatever the scale and scope of your project, Assets America® can secure financing from an extremely broad and diverse range of potential capital sources.

Understanding your Energy Project

By understanding both the specific requirements and, more importantly, the “spirit” of your energy finance request, Assets America® matches you and your energy deal to the optimal energy funding source while providing incredibly detailed and meticulous, transaction evaluation, loan origination, deal structuring, processing, electronic document management, incredibly beautiful and organized energy finance package preparation and submission, term sheet negotiation, third party report coordination, loan commitment negotiation, loan document review, and coordination of loan document signing, funding, recording and closing such that Assets America® ensures that every part of the energy finance transaction is guided with the utmost of care, experience and professionalism to handle and fund the energy project from beginning to end.

Phases of Energy Projects

Energy finance is needed to fund projects that typically involve several phases:

- Exploration: Exploration involves the search for deposits of fossil fuels, such as oil, gas and coal, that are trapped below ground. Exploration can also apply to finding the most suitable sites for solar, wind, geothermal or another types of renewal energy projects.

- Production: Energy production refers to the steps necessary to turn energy sources into energy products for industrial and commercial use. This includes recovering and refining raw fossil fuels from their deposits and generating electricity from renewable resources. Pipelines, refining plants and/or generation plants are typically included in the production phase.

- Transmission: Electrical transmission requires high-voltage lines that rapidly move electricity over long distances. The network of transmission lines is known as the power grid or electrical grid. Electrical cables can be found overhead, underground, and under the seas.

- Storage: Some electricity can be stored in batteries, but most is generated on demand. Fossil fuels can be stored in huge storage facilities and tapped when needed.

Assets America® Provides Energy Finance

Whether you need project financing for a very small, $20 million commercial wind farm or large $20 billion nuclear powerplant, Assets America® can provide you with the appropriate energy finance solutions to meet your needs. The Assets America® difference is focused, dedicated, cohesive and seamless with terms that frequently beat those attained by more conventional methods. When it comes to energy project financing, Assets America® is the name you can trust. Assets America ® works for its clients to analyze their projects, pairing our energy client and the subject energy project with the energy finance structures that will provide the most value. By not being beholden to any particular capital source, we are adept at providing accurate, objective financial representation typically allowing our clients access to various energy finance options. Call us today at (206) 622-3000, or simply fill out the below form for a prompt response!

Apply For Financing

Types of Energy Finance Projects

Energy projects can be categorized by the source or fuel that creates energy for industry and commerce. Renewable energy projects are usually viewed more environmentally friendly than fossil fuel projects. However, fossil fuel projects are necessary to provide the huge amounts of energy required by the world’s population. Both require substantial energy finance.

Traditional Energy Financing Projects

Despite the rapid rise of renewable energy, traditional gas and oil industries still reign supreme over the massive energy sector. Even these long-established industries are a hub of innovation and evolution as companies seek to improve sustainability and optimize delivery. And, while it is extremely important that an energy project minimizes negative environmental effects and reduces waste, the energy project must, of course, be a financially sound and profitable business proposition. This is even more crucial in a crowded supply chain adapting to the digital age and under pressure to increase efficiency gains and improve both its top and bottom lines.

Energy projects are often large-scale, long-term endeavors that involve a range of parties and investors from start-ups to government bodies and carry specific risks not usually found in the context of project finance. Having an in-depth understanding of a project’s objectives as well as the complex logistical, environmental and regulatory context in which it will take place, is essential for the energy project to be matched to the proper energy funding source.

In comparison to our competition, Assets America® can provide you with a commercial, transactional experience that you simply won’t find anywhere else in the commercial, energy sector and capital funding markets. We focus on your business objectives and use our market knowledge and insight to create a secure, productive relationship between you and the private energy or institutional energy capital source that best fulfills our clients’ requirements. Our approach puts our clients at the center, prioritizing attention to detail to ensure deal making is properly formulated at all levels and optimized for each energy finance transaction. We save our clients time and money while simultaneously reducing transactional risk.

Fossil Fuels: Coal, Petroleum, and Natural Gas

Fossil fuels are non-renewable and require expensive extraction from underground reserves. Assets America® is a provider of oil and gas financing, as well as coal financing. These fuels derive from the decomposition of flora and fauna. Another fossil fuel, liquid petroleum gas, is a side product from the production of natural gas.

Coal can be burnt directly in a power plant to turn turbines that produce electricity. It can also be converted into a liquid or gas fuel, but these materials are usually too expensive for generating electricity. A new, coal-fired power plant costs in excess of $2B, including financing costs. The capital cost for a coal-fired powerplant ranged from $4,560 to $6,112 per kilowatt, as of 2017.1

Petroleum and natural gas is extracted from underground reserves. Fracking has allowed oil and gas fields to provide larger yields. Petroleum, commonly called “raw crude,” needs to be refined in chemical plants to constituent materials that can be used for gasoline, diesel fuel, and many other compounds that are used for energy production, chemical processes, drugs, plastics, and many other uses. The capital cost in 2017 for a petroleum/gas-fired powerplant ranged from $899 to $1,687 per kilowatt in 2017.

Renewable Energy Finance Projects

Renewable energy such as wind, solar and hydro power now accounts for approximately one fifth of the total electricity generation in the United States. In fact, in the next decade, it is likely that renewable power generation will overtake nuclear energy as the second largest contributor of power. A large part of this success has been due to beyond amazing innovation, but it has also required the effective utilization and adaption of energy finance structures that have worked so well for conventional power generation.

The kind of energy funding needed for these renewable energy projects can range from project-level finance and technological energy development all the way up to the municipal, state and national levels. Matching a business to the perfect source of energy capital requires up-to-date knowledge of federal tax credits and state-level incentives, as well as attribute markets and site-specific factors like energy technology operation costs. When adding in financing structures that differ massively depending on whether you are investor-owned, a municipal utility or a commercial entity and whether you are working on distributed, mid-size or utility-scale systems, it can be challenging to identify the correct capital source.

Wind Power: Wind Turbines and Wind Farms

Onshore and offshore wind farms harness the power of the wind to turn magnetic turbines that generate electricity. Many of the largest wind farms are located in the U.S., including the Alta Wind Energy Center, Roscoe Wind Farm and Horse Hollow Wind Energy Center. Wind power is renewable and clean, creating essentially no pollution. As of 2014, about 4% of the world’s power came from harvesting wind. In terms of green energy financing, the capital cost for an onshore windfarm in 2017 was about $1,573 to $2,725 per kilowatt, while offshore windfarm construction cost about $5,893 to $8,268 per kilowatt. The largest onshore windfarm has a capacity of 1,320 million kilowatts. Assets America® loves renewable energy project finance and can provide you with energy finance solutions appropriate to your needs; the larger the project, the better!

Biofuel: Biomass

Biofuel is generated from living organisms that are cultivated in biomasses. Biomasses are converted into energy-rich substances through chemical, thermal and biochemical conversion. Principal types of biofuel include bioethanol (derived from plants containing sugar, starch or cellulose), and biodiesel made from animal fats and vegetable oils.

When you consider the capital costs for alternative energy financing, biofuel power plants cost from $3,538 to $4,708 per kilowatt to construct. Energy finance for biofuel energy generation projects are one of the many types renewable energy financing we can provide.

Solar Power: Photovoltaics, Concentrated and Space-Based

Assets America® is a source for financing energy efficiency projects like solar that require solar financing. Solar energy comes from the sun’s heat and light. It can be harnessed through technologies such as:

- Solar photovoltaics: Semiconductor materials (principally silicon) within solar panels convert light into electricity. Solar panel farms are large, ground-mounted arrays with either fixed positions or panels that track the sun’s path for maximum yield. At the start of 2017, global photovoltaic output exceeded 300 gigawatts, or 2% of worldwide electrical demand. Power-purchase agreements price the output of solar farms under 5 cents/kWh. The cost to construct a tracking-panel solar farm ranges from $1,423 to $3,282 per kilowatt, depending on location. As of 2017, the world’s largest solar farm was Tengger Desert Solar Park located in China, generating 1,500MW (megawatts).

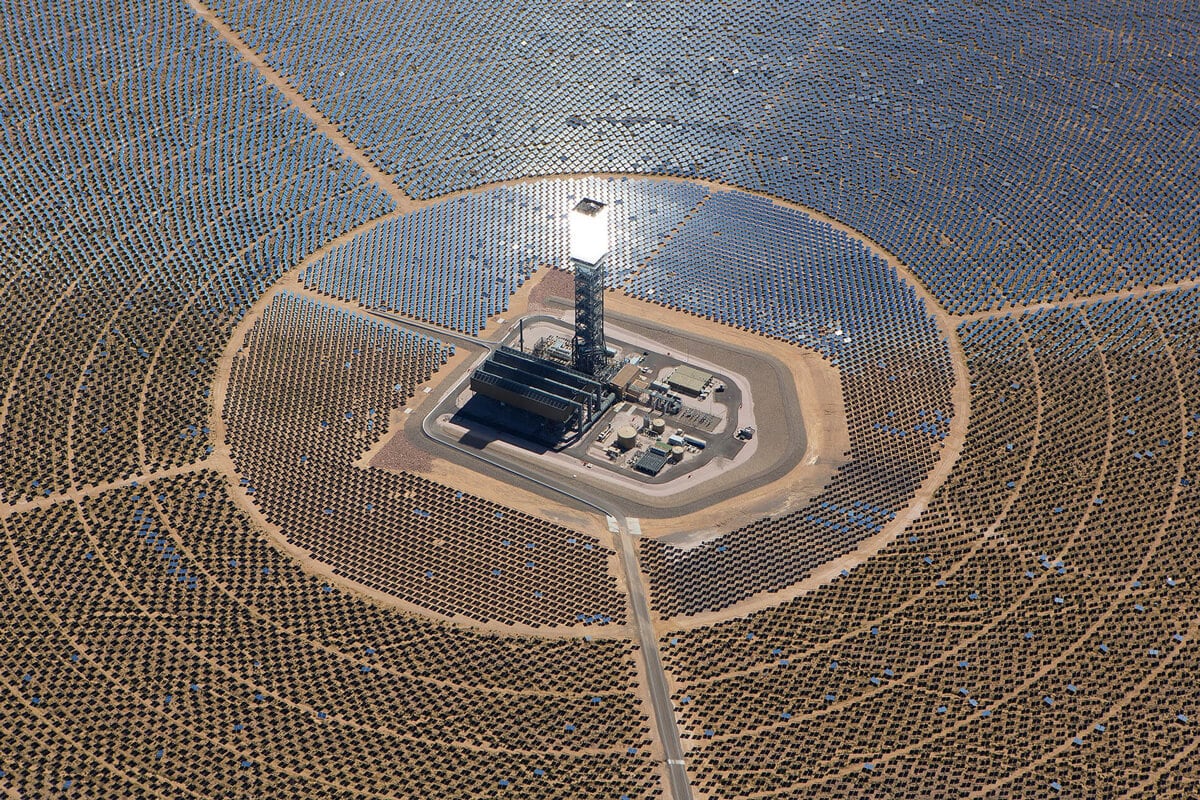

- Solar heating: A solar thermal collector harvests the sun’s heat through hot water panels, solar parabolic dishes or solar towers. Solar power plants typically feature complex trough-shaped reflectors to heat a fluid, drive a turbine and generate electricity. A power tower is a tall structure with tracking mirrors that reflect sunlight to a receiver at the apex of the tower.

- Artificial photosynthesis: This is a promising set of technologies that simulate natural photosynthesis. As of this time, it is in the research stage and has not yet reached commercial deployment.

- Solar architecture: This is an architectural approach that incorporates active and passive solar features into homes, buildings and other structures. It includes building orientation, built-in photovoltaics, thermal mass and other strategies.

Assets America® is keenly interested in providing solar projects financing and other types of new energy finance. The decreasing cost structure of solar panels and equipment make solar energy finance a good investment prospect among all projects requiring energy finance, and we are happy to provide solar financing into the billions of dollars with no upper limit.

Marine Energy

The Earth’s oceans are a huge, and mostly unexploited, source of renewable energy tied to fluid flow, thermal energy, salinity gradients and surface wages. The following sources of renewable marine energy can be tapped with suitable devices and techniques:

- Current power: The sun’s energy helps drive strong currents in the world’s oceans, along with wind, temperature, the Earth’s rotation, topography and salinity. Energy extraction devices such as turbines are currently undergoing research.

- Osmotic power: This power derives from the salinity gradient where salt water meets fresh water. Devices that utilize pressure-retarded reverse osmosis or freshwater upwelling can tap osmotic energy. Energy finance is needed to convert research projects into commercial operations.

- Thermal Energy: Energy differences between surface and deep waters, especially in tropical waters, can be used to drive turbines that generate electricity. As this technology develops, it might become a consumer of energy finance.

- Wave Power: Wind, which itself derives from solar-derived temperature differences, interacts with ocean surfaces to create waves. Devices used to harvest power include overtopping devices, oscillating water columns, surface attenuators and point absorber buoys. Demonstration projects are providing positive results that will soon require energy finance for commercial development.

- Tidal Power: The interaction of the moon with the oceans creates tides, a form of hydroelectric power. Tidal power takes three major forms: dynamic tidal power, tidal barrage power and tidal stream power. This source of power looks very promising and may soon require significant energy finance capital.

Hydrogen

Hydrogen is already used in fuel cell vehicles. It does not create hydrocarbon pollution and combines with atmospheric oxygen to form water vapor as the sole emission. A fuel-cell-powered electric motor is two to three times more efficient than a gasoline motor. A national infrastructure for hydrogen delivery will require vast amounts of energy finance.

Geothermal Power

This is power sourced from temperature differences at and just below the Earth’s surface. The temperature gradient is used to generate electricity and geothermal heating. Geothermal power is already in commercial use around the world and offers great promise as research finds ways to further lower costs. The requirements for energy finance in this area are significant.

Hydroelectricity

This is electricity generated by water pressure at dams and waterfalls harnessed to turn turbines. Dam construction is a huge consumer of energy finance.

Nuclear Energy

Nuclear reactors provide energy by providing heat to boil water that turns steam turbines. A nuclear power plant can cost north of $10B, and Assets America® is happy to provide energy financing for this market.

Glossary of Energy Finance Terms

| Term | Definition |

|---|---|

| Biogas | Electricity produced from methane, typically recovered from coal beds |

| Community Ownership | Due to the extremely high costs of funding large-scale energy ventures, it is common for businesses to seek funding as a collective, especially for wind power |

| Development Finance Institution (DFI) | Also called development banks, these institutions provide credit for higher risk loans to private sector investments in developing countries |

| Efficiency Gains | An increased profit margin achieved typically by lowering production costs and other major expenses |

| Green Bank | A financial institution for financing clean energy projects |

| Renewable Electricity Production Tax Credit (PTC) | A tax credit from the U.S. Government measured per kilowatt-hour in the case of energy produced by wind, geothermal, closed-loop biomass, and many other renewable energy sources |

| Solar Investment Tax Credit | Another tax credit from the U.S. Government levied at 30% for the cost of a solar energy system, applicable to both residential and commercial properties |

| Term Sheet | Also called a Letter of Interest, a term sheet is a non-binding overview of a transaction or deal in order to ensure that all involved parties are in agreement on the scope and terms of a transaction, usually a loan |

| Transaction Risk | The possibility of exchange rates changing within the time period between entering into a contract and settling it, typically reduced by expediting contract negotiations |

Characteristics of Energy Finance

Energy projects are funded by one or more of the following sources: banks, private investments including venture capital, municipalities and government agencies. Energy finance is characterized by its risks and its financing mechanisms.

Risks

The following risks must be considered when providing energy finance to specific projects:

- Financial: Energy finance from private sources rests upon the availability of risk-adjusted capital at an affordable price relative to projected revenues. Costs are heavily front-loaded while payback is relatively slow. Financial risks include geopolitical, currency, liquidity, regulatory and counterparty risk.

- Tech Disrupters: Expensive investments might be undercut by technological breakthroughs that render older technologies obsolete.

- Operations: The operation of a power plant can be disrupted by delays in the availability of grid interconnection and/or transmission line interfaces, among many reasons.

Financing Mechanisms

Energy finance risks can be somewhat mitigated by the appropriate financing mechanisms, including:

- Public Funding: Public finance institutions account for about 15% of total renewables investments.2 Public capital from various levels of government finance public and private energy projects. Property Assessed Clean Energy (PACE) financing, from the U.S. Department of Energy, is an example of public funding.

- On-lending Structures: This is lending via a development finance institution (DFI) with high credit quality and access to credit. DFIs borrow debt at low rates and on-lend them to governments and other institutions via credit lines.

- Loan Syndication: This is lending arranged with a group of lenders who participate in a project together. DFI’s often co-lend with commercial banks to distribute the risks among a larger group of lenders.

- Subordinated Debt: This is lower-quality, higher-interest debt that helps insulate senior debt from risk. It is a form of mezzanine financing that can unlock additional energy finance, the aggregate of which increases the overall loan-to-cost (LTC) on a project.

- Convertible Grants: Public finance institutions can offer grants that transition to loans. They facilitate the high-risk early stages of projects requiring energy finance.

- Convertible Loans: These start out as loan that can be converted into high-risk, high-return equity following the riskiest early stages of an energy finance project.

- Standardized Contracts: These reduce the complexity of conventional contracts, thereby lowering due diligence costs, for servicer requirements, ownership structures, power purchase agreements (PPAs) and so forth. A PPA is a contract between energy consumers and producers that defines all commercial terms, including schedules, payments, penalties and termination terms.

- Aggregation: To justify their due diligence and transaction costs, smaller energy projects are often aggregated to the size of large utilities. This allows institutional investors to participate in projects that would otherwise fail to satisfy their minimum investment benchmarks.

- Securitization: Through securitization, project sponsors can issue securities with a wide range of risk/return profiles to fund an energy project. The securities are backed by assets that are assigned to a separate special purpose vehicle (SPV), thereby protecting large companies from individual project risks associated with energy finance. These act almost like an insurance policy by spreading the risk.

- Credit Ratings: Different energy projects require different types of due diligence. Credit ratings act as proxies for due diligence by providing expert assessments of creditworthiness to support energy finance.

- Green Bonds: These are fixed-income securities that finance environmental or climate-related investments, and are increasingly used for renewable energy finance. They are similar to securitization in that they are backed SPVs.

- Yieldco Structure: These are equity-based securities used by utilities and other owners of renewable energy assets to partially spin off operating assets. The money raised by the spin-off is used to fund new projects. The structure facilitates tax-efficient distribution of free cash flow to shareholders.

Online Resources

- For independent analysis and statistics on the U.S. energy market, use the resources provided by the U.S. Energy Information Administration. The EIA also provides information on financing trends.

- You can also use the Open Energy Data from the U.S. Department of Energy.

- Remain up-to-date with energy market news from MarketWatch.

- The International Energy Organization proclaims itself as the “global energy authority” and provides visitors with news, data analysis, and solutions on the international energy market.

Contact Us

The Assets America® difference is focused, dedicated, cohesive and seamless with terms that frequently beat those attained by more conventional methods. For more information about how we can help you obtain the ideal energy finance terms for your large energy project, call us today at (206) 622-3000!

Footnotes

1 Cost and Performance Characteristics of New Generating Technologies, Annual Energy Outlook

2 Unlocking Renewable Energy Investment